Darren415

Written by Nick Ackerman, co-produced by Stanford Chemist. A version of this article was originally published to members of the CEF/ETF Income Laboratory on February 10th, 2023.

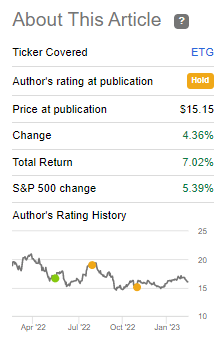

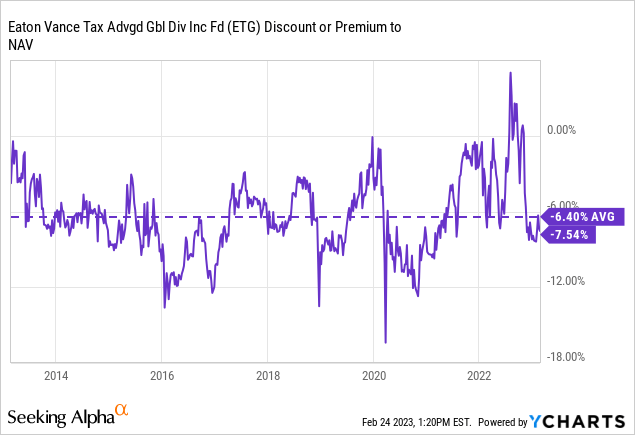

Eaton Vance Tax-Advantaged Global Dividend Income Fund (NYSE:ETG) has moved to a wider discount than when we last took a look at the fund. At that time, the discussion focused on the fund's distribution cut. As an equity fund, a bear market doesn't generally yield great results. Thus, the second distribution cut in this fund's history happened. However, at that time, the discount was still fairly narrow. Now we've seen that widen out to a more compelling level.

Additionally, since that previous update, the fund has been performing quite well. More recently, volatility has picked back up for equities, but there still was some rebounding since our last update. While the S&P 500 Index isn't a direct benchmark, it can be used as a way to provide some context of the overall market. ETG has outperformed the broader market since that time on a total return basis.

ETG Performance Since Prior Update (Seeking Alpha)

These returns reflect the share price, but since we know the discount has widened further, it suggests that the fund's underlying portfolio or NAV has performed even better. Equities are still susceptible to volatility as we enter into a year that is anticipated to include a recession. Being a leveraged fund, that means we will see even more amplified moves, whether up or down. However, considering a position at today's discount could be a compelling option for a long-term investor.

The Basics

- 1-Year Z-score: -1.08

- Discount: -7.54%

- Distribution Yield: 7.48%

- Expense Ratio: 1.14%

- Leverage: 22.7%

- Managed Assets: $1.63 billion

- Structure: Perpetual

ETG invests "primarily in global dividend-paying common and preferred stocks and seeks to distribute a high level of dividend income that qualifies for favorable federal income tax treatment." This means they are looking for companies whose dividends are considered to be qualified dividend income. Of course, that is good for investors who might hold this in a taxable account. It would reduce the tax obligation for an investor, which is where the "tax-advantaged" portion of its name comes from.

The fund is moderated leveraged, but that still doesn't mean it avoids the standard risk with leverage being more volatile. Any leverage will increase downside potential, as well as upside potential.

On top of this, with rising interest rates, leverage costs have been skyrocketing. They pay an interest rate of 1 month LIBOR plus 0.50%. At the end of the fiscal year 2022, the rate was 3.80%. Their fiscal year ends in October. Since then, interest rates have only gone higher, and therefore, the cost of their leverage has only further increased. The fund's total expense ratio came to 1.58% when including leverage expenses.

Performance - Tough 2022, Strong Track Record

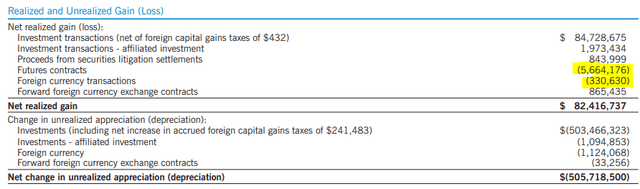

The fund generally operates a pretty straightforward portfolio of investing in equity and debt positions without employing derivatives. Perhaps a good reason to stick to that is included in the latest annual report, they employed futures contracts, and it was a detractor from performance. The contracts actually lost the fund money through the year but were an attempt to hedge against European equity exposure.

The Fund's use of equity index futures contracts, a type of derivative, was a minor detractor from performance relative to the Index. Within the Fund's common stock portfolio, the Fund's strategy of emphasizing dividend-paying stocks resulted in an overweight allocation to European equities and an underweight allocation to U.S. equities. The Fund hedged these overweight and underweight exposures by short-selling European index futures contracts and buying U.S. index futures contracts. Both the European and U.S. index futures contracts were no longer in effect as of period-end.

Along with that, the foreign currency transactions also contributed to some losses for the fund.

ETG Derivative Losses (Eaton Vance)

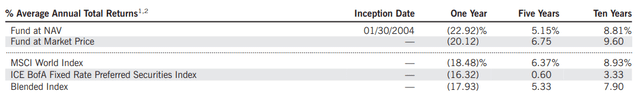

That being said, over the longer term, the fund has put up stronger or more competitive results compared to the benchmark it includes for comparisons.

ETG Annualized Returns Compared To Benchmarks (Eaton Vance)

Important to note that the time these performances were presented was at the end of October. That's when the fund was actually trading at a premium. Since then, we've seen a discount open back up. Traditionally, this fund has traded at a discount, so buying at a premium isn't suggested. We are now trading slightly below the longer-term average discount.

That would indicate a time that one could consider entering a position. Perhaps not the greatest time or a "back up the truck" moment, but a time to consider a dollar-cost average approach. The market turning weaker overall again is helping to present a lower share price too.

Distribution - NII Coverage Falls

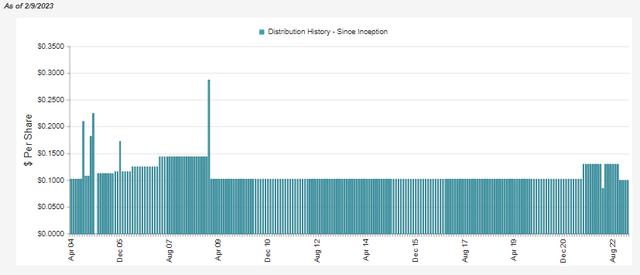

This fund has been a steady payer since the GFC. They then raised at the end of 2021 when everything was rallying. Unfortunately, that was just before the bear market of 2022.

ETG Distribution History (CEFConnect)

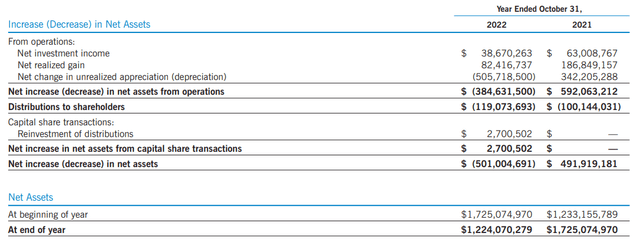

One of the causes for the distribution cut could be attributed to a big shift in the fund's net investment income. In 2019, the NII coverage was nearly 100%.

For an equity fund, that is incredibly rare and practically unheard of. However, the trend of strong NII has come down since that time. The latest NII coverage for 2022 comes to just 32.5%. A drop from 63% in the prior year.

Some of this decline is simply from rising leverage costs. Last year's borrowings cost them $2.325 million. Fiscal 2022's leverage expenses came to a whopping $6.4 million, with only more to go for fiscal 2023.

ETG Annual Report (Eaton Vance)

Going forward, they would be paying out around $91.843 million, factoring in the distribution cut. NII coverage based on the latest NII number would be 42.1%, but we know with increasing leverage costs, it will be lower.

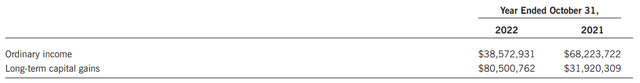

For tax purposes, the fund shows a breakdown of ordinary income and long-term realized capital gains. This is fairly standard for the fund.

ETG Distribution Tax Classification (Eaton Vance)

The tax-advantaged part is the long-term capital gains being taxed more favorably. Additionally, 100% of 2021's distribution that was identified as ordinary income was considered qualified dividends. Meaning that those, too, were tax-advantaged at a lower relative rate than ordinary income.

ETG's Portfolio

The sort of change we see in NII doesn't come from a stagnant portfolio. Most of what ETG invests in generally raises its dividends annually. That would mean we could expect to see NII increases help negative higher expenses through leverage. Since that isn't the case, we know that there is a shift in underlying portfolio holdings toward lower-yielding stocks.

As an actively managed fund, ETG is on the more active side. The latest year showed a portfolio turnover of 59%. That was actually the lowest in the last five years, as it was as high as 224% in 2020.

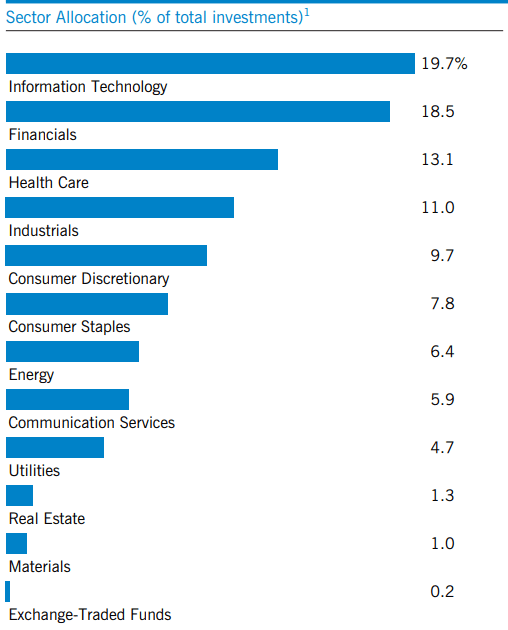

One shift that has taken place is tech becoming the largest weighting. This was the position at the end of October 2022.

ETG Asset Allocation (Eaton Vance)

At the end of April 2022, financials were the largest weighting in the fund. Although not an overly dramatic shift, the weightings had financials at 19.3% and tech at 17.1%. However, it can still explain some of the shifts in the yields the fund has been able to achieve.

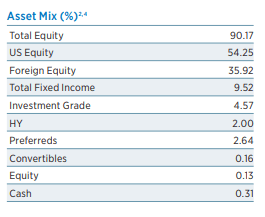

Overall, the portfolio has gone a bit heavier into equity positions. The fund is generally overweight equity positions but was previously at 85.58%. Here's the asset mix at the end of December 2022. Exposure to fixed income decreased across every type of sector, investment-grade, high-yield, preferreds and convertibles. That could be another factor in why we see a reduction in yields generated in the portfolio.

ETG Asset Mix (Eaton Vance)

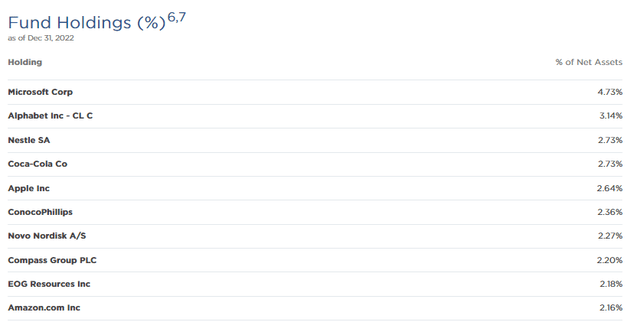

All that being said, the fund has generally carried exposure to large-cap tech names. Microsoft (MSFT), Alphabet (GOOG), Apple (AAPL) and Amazon (AMZN) have all been fairly regular names in some weighting or another for this fund. Interestingly, when comparing the top ten holdings at the end of December 2022 relative to September 2022, we've seen AAPL and AMZN drop in their position in the top ten through a decline in the weightings of net assets.

ETG Top Ten Holdings (Eaton Vance)

AAPL was in the fourth largest position with 3.23% weighting. AMZN was in the third largest position with a 3.28% allocation but is now barely in the top ten at the tenth spot. This also defers the top ten holdings listed in the fund's annual report. So, what this could suggest is that they've shifted once again away from tech in the last couple of months of the year.

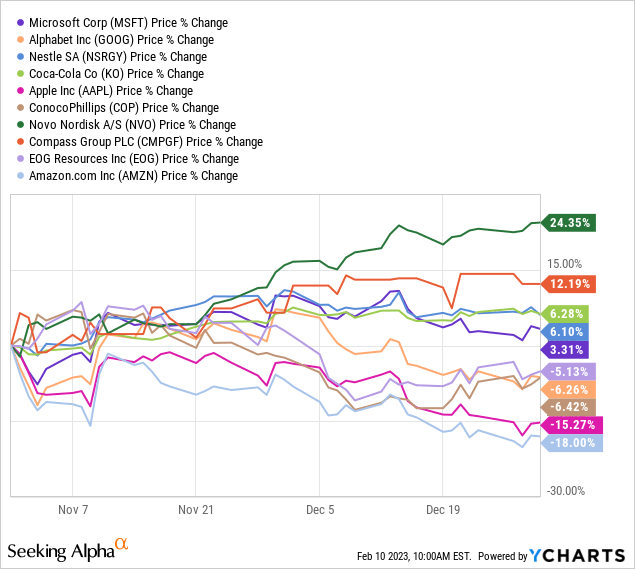

That being said, with normal portfolio shifts during this time, it could also be playing a big role. AMZN and AAPL were the worst performing by far in the last couple of months of 2022 relative to the other top ten names.

Ycharts

On the other hand, given how high the turnover for this portfolio is, it wouldn't be too shocking to see a change in such a short period of time, either. However, that comes with another thing to consider for investors. It puts us as investors in a bit of an unknown of knowing exactly what we might be holding at any given time. When funds are managed with a more aggressive turnover, we rely more on management. Trusting Eaton Vance managers, in this case, has historically paid off.

For me, I preferred the fund's overweight to financials or other value sectors such as healthcare and less emphasis on tech holdings. I wouldn't complain if the fund went back to more of that positioning. If that is the case, we could see the fund generate higher yields and NII from the portfolio to help offset the increases in its leverage costs.

Conclusion

ETG's discount continues to widen after the distribution cut last year. While this was expected, the fund took some time to reach this more attractive entry level. We are now trading below the fund's long-term historical average discount. At the same time, we still aren't at a deep enough discount to go overboard. Utilizing a more cautious dollar-cost average approach could be appropriate for a long-term investor.

"entry" - Google News

February 25, 2023 at 02:44PM

https://ift.tt/VfAS9xu

ETG: Discount Widening Further Presents A Better Opportunity For Entry (NYSE:ETG) - Seeking Alpha

"entry" - Google News

https://ift.tt/EoTFzUw

https://ift.tt/rChZ2QI

Bagikan Berita Ini

0 Response to "ETG: Discount Widening Further Presents A Better Opportunity For Entry (NYSE:ETG) - Seeking Alpha"

Post a Comment