De Blog Have Fun |

- Snow Man阿部亮平ら“ジャニーズクイズ部”テレビ初登場 風間俊介も応援 - モデルプレス

- 逃げない&一途な『半沢直樹』~堺雅人も視聴者も傾向が酷似!?~(鈴木祐司) - Yahoo!ニュース - Yahoo!ニュース

- Lewandowski not targetting Ronaldo's Champions League record ahead of Barcelona clash - Goal.com

- 名人戦にAbemaTVトーナメント。七冠が集結した「将棋まつり」で輝いたのは?(遠山雄亮) - Yahoo!ニュース - Yahoo!ニュース

- Watch Alabama principal’s viral ‘Islands in the Stream’ coronavirus video - AL.com

- Un dîner-croisière sous la chaleur et sous les masques - Courrier picard

- フリーアナウンサーの塩地美澄「写真集」5位発進 “癒やしボディ”を限界露出 - ORICON NEWS

- Hope in defeating COVID-19: More therapeutic and vaccine advances - Medical News Today

- Catherine O’Hara (‘Schitt’s Creek’) leads Emmy odds for comedy actress, but who’s in 2nd place? - Gold Derby

- Lionel Messi bested 5 defenders and was pushed to the ground before scoring another miraculous goal - Insider - INSIDER

- How to help Beirut explosion victims - CNN

- Jokowi lauds Indonesian innovations in fight against COVID-19 - ANTARA English

- ジャンプ編集部、漫画『アクタージュ』原作者の逮捕報道に謝罪「重く受け止めております」 - ORICON NEWS

- 流れ星・ちゅうえい コロナ感染 - auone.jp

- 小島瑠璃子『キングダム』原作者・原泰久氏との交際報道に言及「もうその通りです」 - ORICON NEWS

- 小島瑠璃子『キングダム』原作者・原泰久氏との交際報道に言及「もうその通りです」 - auone.jp

- 結婚発表した瀬戸康史&山本美月、祝福の声にそろって喜び 「パワーを貰えました」「嬉しかった」 - ねとらぼ

- Edited Transcript of AX_u.TO earnings conference call or presentation 7-Aug-20 5:00pm GMT - Yahoo Finance

- Artis Real Est In Tr (ARESF) CEO Armin Martens on Q2 2020 Results - Earnings Call Transcript - Seeking Alpha

- Princess Diana's Bridesmaid Opens Up About Her Visit to Jeffrey Epstein's Island - Yahoo Singapore News

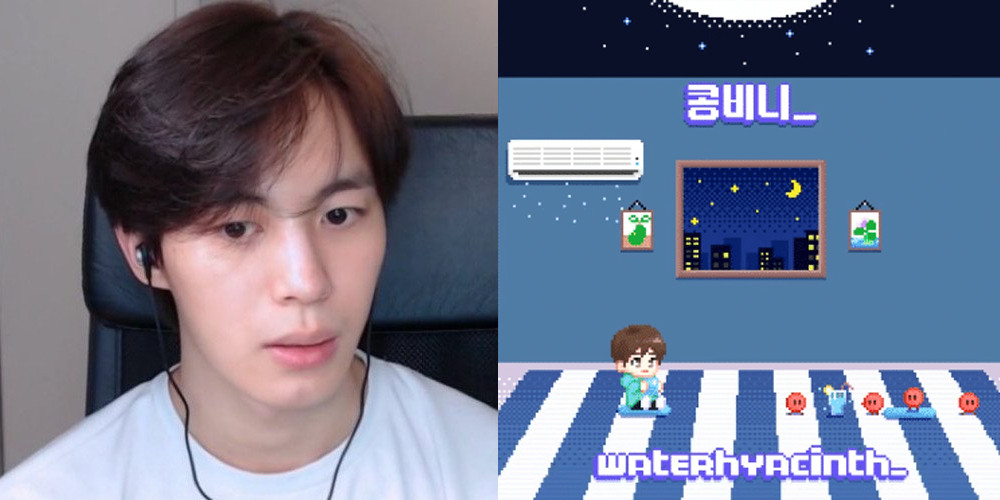

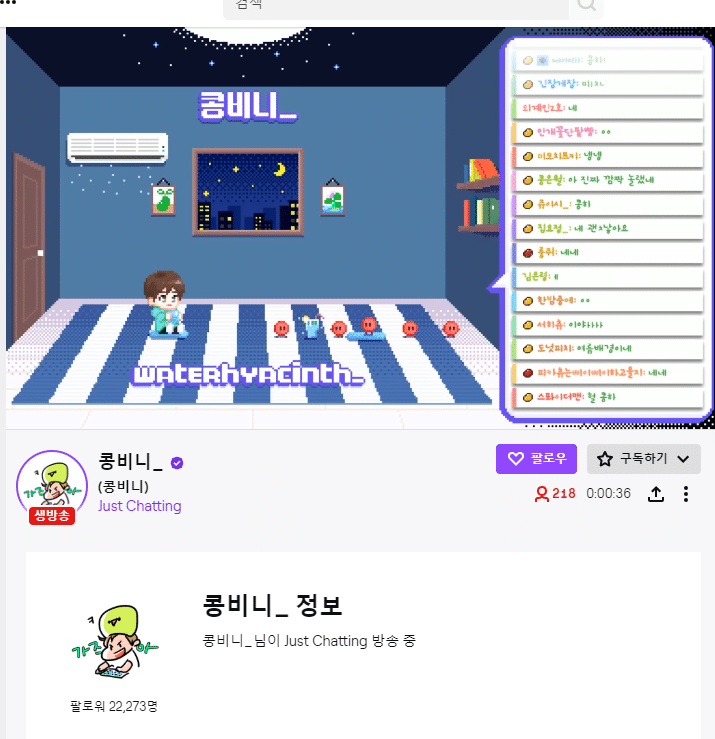

- Starlights disappointed after seeing Hongbin returning to his Twitch activities an hour after official Jellyfish announcement - allkpop

- 柳楽優弥、三浦春馬さんに「ごめんね」 撮影で優しさがにじみ出て… - goo.ne.jp

- 14 of the most outrageous things Trump said in his latest speech - indy100

- Volunteers release thousands of baby sea turtles into the ocean | ABC News - ABC News

- 渡辺二冠がすごい手 名人の長考「間違いない」~飯島七段の解説【第78期将棋名人戦第5局】 - 朝日新聞社

| Snow Man阿部亮平ら“ジャニーズクイズ部”テレビ初登場 風間俊介も応援 - モデルプレス Posted: 09 Aug 2020 12:11 AM PDT Snow Man阿部亮平ら"ジャニーズクイズ部"テレビ初登場 風間俊介も応援 - モデルプレス Snow Manの阿部亮平、Travis Japanの川島如恵留、美 少年の那須雄登、浮所飛貴、7 MEN 侍の本高克樹(※「高」は正式には「はしごだか」)、Aぇ! groupの福本大晴が、10日放送のテレビ朝日系バラエティ番組『クイズプレゼンバラエティー Qさま!!』(よる8時半~)に出演する。 阿部亮平ら、高学歴"ジャニーズクイズ部"テレビ初登場阿部率いる、ジャニーズJr.の川島、那須、浮所、本高、福本ら、ジャニーズ屈指の高学歴メンバーによって結成された「ジャニーズクイズ部」が、テレビに初登場。"高学歴ジャニーズ軍団"として、カズレーザー率いる"Qさま!!軍団"とガチンコ対決を繰り広げる。もともと、ジャニーズJr.公式エンタメサイト「ISLAND TV」内でクイズ企画をスタートさせ、それがきっかけで結成されたという「ジャニーズクイズ部」。気象予報士や宅地建物取引士など難関資格を持っていたり、早稲田理系、慶応ボーイ、国公立大、そして法学部に在籍しながら弁護士を目指していたりと、それぞれがカラフルで錚々たる肩書きを持っている。 天が「二物も三物も与えた」インテリ男子たちが、カズレーザー、石原良純、伊集院光、宇治原史規、弘中綾香アナウンサー、乃木坂46の山崎怜奈という同番組最強の布陣に挑む。 阿部亮平「心強かった」「ジャニーズクイズ部」のテレビデビュー、そして同番組への初出演に、メンバーたちは一様に緊張の面持ち。これまではそれぞれが単独で同番組に登場したことはあっても、ジャニーズの仲間たちと一緒にというのは初だったこともあり、阿部は「仲間がいてくれて心強かった」と胸をなでおろしていた。また、「ジャニーズクイズ部」結成後、メンバーみんなで会うのは、この収録が最初だったそうで「今回の『Qさま!!』で結束力が強くなった」(川島)、「クイズを解くたびに仲が深まった気がする」(那須)、「みんなで出ることができて本当に嬉しい」(浮所)とコメント。さらに、「これがスタート地点で今後もっと活躍していきたい」(本高)、「グループを越えた交流はなかなかない機会」(福本)と、口々にチームワークの良さを強調した。 風間俊介が応援対戦クイズの内容は、人気の漢字ケシマスや英語ケシマス、ドボンマスなどに加え、新形式の「うそつき3択」という楽しいクイズも実施。チームバトルの展開は予想外に激しく、MCのさまぁ~ず、そしてクイズ大好きを公言する高山一実(乃木坂46)も、手に汗を握りっぱなしとなる。さらに、「ジャニーズクイズ部」を応援すべく、ジャニーズ事務所の先輩である・風間俊介が今回特別に、問題解説ナレーションを担当。後輩を応援しながら、ナレーションを務める。(modelpress編集部) 【Not Sponsored 記事】 2020-08-09 06:20:00Z https://news.google.com/__i/rss/rd/articles/CBMiI2h0dHBzOi8vbWRwci5qcC9uZXdzL2RldGFpbC8yMTc2NTI50gEgaHR0cHM6Ly9tZHByLmpwL25ld3MvYW1wLzIxNzY1Mjk?oc=5 |

| 逃げない&一途な『半沢直樹』~堺雅人も視聴者も傾向が酷似!?~(鈴木祐司) - Yahoo!ニュース - Yahoo!ニュース Posted: 08 Aug 2020 11:11 PM PDT 逃げない&一途な『半沢直樹』~堺雅人も視聴者も傾向が酷似!?~(鈴木祐司) - Yahoo!ニュース - Yahoo!ニュース 快進撃が続く堺雅人主演『半沢直樹』。 TBSの佐々木卓社長も7月の定例記者会見で「半沢は別格で大きく期待」と述べるほど、今や特別な番組になっている。 その強さの要因はいろいろあるが、視聴者の見方を分析すると"逃げない"=「途中で脱落しない」ことと、"一途"=「全話見続ける」人が多い点が特徴だ。 他のドラマとどう違うのか、分析してみた。 視聴者は"浮気者"テレビドラマの視聴者は、一般的には"浮気者"が多い。 どんなに魅力的な連ドラでも、自分の都合である回は見るが、別の回を見なかったりするものである。 関東地方で41万台のインターネット接続テレビの利用状況を調べる東芝映像ソリューションの「TimeOn Analytics」によれば、1クール3か月で10話前後ある連続ドラマを毎話欠かさず見る人はごく一部。中には10人に1人もいないドラマもあり、如何に視聴者が"浮気者"か統計的に浮かび上がる。  図1は今期がシリーズ第2弾となった4ドラマを、初回から3話までの視聴パターンで比較したもの。 「ライブで見た」あるいは「録画再生で見た」パターンを含めて調べているが、まず目につくのは『半沢直樹』の圧倒的な人気。初回の視聴は23.43%に達し、2位『ハケンの品格』に9ポイントほど、3位『BG~身辺警護人~』の2倍、4位『SUITS/スーツ2』3倍以上となった。 ただし絶好調の『半沢直樹』ですら、初回から3話まですべて見た(濃い緑色の部分)のは、1話でも見た全体(28.32%)の半分強となってしまう。 それでも半分強が見続けるのは画期的なこと。 『ハケンの品格』も『BG』も半分に届いていないし、『SUITS/スーツ2』に至っては4分の1にも届かない。全話を見続ける"一途"な視聴者が多い、つまり多くの人がハマっているかがわかる。 視聴者が"逃げない"『半沢直樹』のもう一つの特徴は、視聴者が途中で"逃げない"(=脱落して見るのをやめない)こと。 黄色や赤色の部分は、一旦見始めたものの2話や3話を見なかった人。逆に水色は、2話から見始めて3話も見た人。青色は、初回を見て2話を見なかったが、3話で復帰した人だ。 この分類で見ると、初回か2話を見たが3話を見なかった人は、『半沢直樹』が5.29%で最も高い。 ただし初回や2話を見た比率が圧倒的に高いために、3話脱落者の絶対数が多くなっている。これを図2のように、初回の視聴数を1として各パターンを指数化すると、各ドラマを見始めた人の3話までの行動パターンの比較がわかりやすくなる。  初回を見た中で『半沢直樹』3話を見なかったのは22.6%。 『BG』25%、『ハケンの品格』29.1%より低い。ちなみに『SUITS/スーツ2』だと62.5%にも及ぶ。このドラマの場合、番宣が十分に効かなかったのか、初回の視聴が低調だった。ただし2話で初回の77.9%もの人が新たに見始めるという普通はあまり見られない現象が起こった。 しかもコロナ禍の影響で2話と3話の放送が2か月以上空いたためか、3話を見なかった人が大量に出てしまった。 いずれにしても初回視聴を1とすると、3話まで見続ける率65.6%は断トツに高い。逆に3話を見なかった率22.6%は圧倒的に低い。 第1弾が好評で今期が第2弾となった4ドラマをはじめ今期の全ドラマの中で、唯一20%台で視聴率を上げ続ける『半沢直樹』。 視聴者が"逃げない"かつ"一途"である以上、4話以降も大いに期待できそうだ。 どこまで視聴者の期待を良い意味で裏切り続け、物語の展開にハメてくれるか見届けたい。 2020-08-09 04:31:20Z https://news.google.com/__i/rss/rd/articles/CBMiPWh0dHBzOi8vbmV3cy55YWhvby5jby5qcC9ieWxpbmUvc3V6dWtpeXVqaS8yMDIwMDgwOS0wMDE5MjQwNS_SAQA?oc=5 |

| Lewandowski not targetting Ronaldo's Champions League record ahead of Barcelona clash - Goal.com Posted: 08 Aug 2020 09:42 PM PDT  Robert Lewandowski shut out thoughts surrounding individual records and fixed his focus on firing Bayern Munich past Barcelona in the Champions League quarter-finals after notching another brace in Saturday's triumph over Chelsea. The Poland international improved his season goal tally to 53 in all competitions as he scored twice and assisted another two in a 4-1 victory at the Allianz Arena that saw Bayern advance from the last 16 as 7-1 aggregate winners. Lewandowski now has 13 goals in seven Champions League appearances this term, four behind the record Cristiano Ronaldo set for a single season in 2013-14. But the prolific 31-year-old striker insisted he is more interested in helping his side progress from next Friday's single-leg quarter-final in Lisbon, where Barca await following their 4-2 aggregate win over Napoli. "It's not a target for me," Lewandowski told Sky Germany when asked about Ronaldo's record. "We have another knockout game to come and have to play really well as a team. "The most important thing is to play well and reach the next round. We have to show as a team we are better [than Barcelona] in order to reach the semi-finals. "Barcelona are always dangerous and play great football. We have to be at it from the first minute and show our quality. The better team will play in the next round." Lewandowski played a direct part in every goal for Bayern in their 7-1 aggregate victory over Chelsea, having also scored one and set up a couple for Serge Gnabry in February's first leg at Stamford Bridge. Head coach Hansi Flick was keen to praise his whole side and not just in-form Lewandowski, who has netted more times in 2019-20 than any other player in Europe's top five leagues. "He scored twice, so it goes without saying what he can do," the Bayern boss said. "This is what makes us stand out as a team. "I was very satisfied with the 90 minutes from everyone. We wanted to win the game and pick up from where we left off. "Chelsea have an exciting team and an incredible amount of speed. It would have been our fault if we let them into the game, but the first 30 minutes from us were great." The only sour note for Bayern was the sight of Jerome Boateng hobbling off with an apparent knee injury in the second half, but Flick was hopeful the centre-back would be fit for next week's huge showdown with Barca. "I don't think it is so bad for Jerome," he said. "That's the information I got from the medical staff. [Benjamin] Pavard is also trying everything to be ready. "We will prepare for that game like any other. We want to show our strengths again and must be 100 per cent focused, not just on Lionel Messi but every player." "Goal" - Google News August 08, 2020 at 05:28PM https://ift.tt/3ifGMTE Lewandowski not targetting Ronaldo's Champions League record ahead of Barcelona clash - Goal.com "Goal" - Google News https://ift.tt/35TEe8t Shoes Man Tutorial Pos News Update Meme Update Korean Entertainment News Japan News Update |

| 名人戦にAbemaTVトーナメント。七冠が集結した「将棋まつり」で輝いたのは?(遠山雄亮) - Yahoo!ニュース - Yahoo!ニュース Posted: 08 Aug 2020 09:10 PM PDT 名人戦にAbemaTVトーナメント。七冠が集結した「将棋まつり」で輝いたのは?(遠山雄亮) - Yahoo!ニュース - Yahoo!ニュース 8日に2日目が指し継がれた第78期名人戦七番勝負第5局は、渡辺明三冠(36)が豊島将之名人(30)に128手で勝利し、通算成績を3勝2敗として名人位獲得まであと1勝とした。 同日、AbemaTVトーナメント準決勝が行われ、チーム永瀬(永瀬拓矢二冠・藤井聡太棋聖・増田康宏六段)がチーム康光(佐藤康光九段・谷川浩司九段・森内俊之九段)を破り、決勝進出を決めた。 将棋ファンにとっては、終日にわたって将棋を楽しめる一日になった。 タイトルホルダーが集結する姿は、さながら「将棋まつり」のようだった。 たどり着いてまだ互角名人戦は、1日目から豊島名人が攻勢に出た。 互いの研究範囲で進んでいたが、局後の感想によると、渡辺二冠は構想がうまくいっていないと感じていたようだ。 現に、封じ手の段階では豊島名人有利とみられていた。 しかし、2日目に入って渡辺二冠が巻き返す。 豊島名人も耐えて、18時の夕食休憩では再び互角に戻っていた。 3連勝ABEMAで17時に配信が始まったAbemaTVトーナメント。 こちらは団体戦で、先に5勝したチームの勝利となる。 ここでチーム永瀬が出だしから3連勝! 1回戦:×佐藤九段―藤井棋聖◯ 2回戦:×谷川九段―永瀬二冠〇 3回戦:×森内九段ー増田六段◯ 勝負の行方は早くも決まったかのようにみえた。 その頃、名人戦でも動きがあった。 豊島名人に判断ミスがあり、渡辺二冠に形勢が傾き始めたのだ。 永瀬二冠&藤井棋聖を連破勝負あったかにみえたAbemaTVトーナメントにも大きな動きがあった。 佐藤九段が1勝を返して迎えた第5回戦。森内九段が藤井棋聖を破ったのだ。 藤井棋聖の攻めを強靭な受けで跳ね返し、最後は自玉を安全にしてから万全の態勢で寄せきる強い内容だった。 これで通算成績はチーム永瀬の3勝2敗に。 そして増田六段が勝ってチームの勝ち抜けまであと1勝となった第7戦。 ここで再び輝きを見せたのが森内九段だった。 永瀬二冠の猛攻をこちらも強靭な受けで跳ね返した。 何度も森内玉がピンチにさらされたが、あと一歩攻め手が届かなかった。 4回戦:◯佐藤九段―永瀬二冠× 5回戦:◯森内九段ー藤井棋聖× 6回戦:×谷川九段―増田六段〇 7回戦:◯森内九段ー永瀬二冠× 名人位まであと1勝名人戦は、渡辺二冠が有利になってから着実にリードを広げていった。 いつも以上に手堅い指しまわしには、初の名人位にかける思いを感じた。 前日の1日目は終始押され気味だった渡辺二冠だが、2日目に入って指し手が冴え渡った。 この日一番の輝きを見せたのは、渡辺二冠と言っていいだろう。  最後に魅せたのは大詰めを迎えたAbemaTVトーナメント、第8回戦は藤井棋聖ー佐藤九段の対戦に。 この二人は第1回戦でも対戦があり、乱含みの一局を藤井棋聖が逆転で制した。 第8回戦は矢倉のねじり合いになった。 超早指しとは思えない密度の濃い戦いに、ファンもそして筆者もうなりながら観戦していた。 終盤、詰む詰まないが絡む難解な攻防が繰り広げられた。 残り時間数秒の中、詰む詰まないを正確に読み切り、ギリギリのところで藤井棋聖が佐藤九段の追撃を振り切った。 最後の最後に輝きをみせたのは、持っている男、藤井棋聖だった。 チーム永瀬が5勝3敗となり、決勝進出を決めて長い一日は幕を閉じた。 9回戦:×佐藤九段―藤井棋聖◯ 叡王戦チーム永瀬とチーム渡辺(渡辺明二冠、近藤誠也七段、石井健太郎六段)の決勝戦は22日(土)にABEMAで生中継される。 名人戦第6局は14日(金)・15日(土)に行われる。 渡辺二冠、悲願の名人位獲得なるか。注目の一番だ。 そして昨日激戦を繰り広げた豊島名人・竜王と永瀬二冠は、明日(10日)再び戦いが待っている。 叡王戦七番勝負第7局だ。 ここまで2勝2敗2持将棋と死闘の様相をみせるシリーズ。 本局はシリーズ初の持ち時間6時間での対局となる。 名人戦七番勝負、叡王戦七番勝負、AbemaTVトーナメントと、どれも佳境に入ってくる。 死力を振り絞る男たちの戦いの行く末にご注目いただきたい。 2020-08-09 03:37:06Z https://news.google.com/__i/rss/rd/articles/CBMiQGh0dHBzOi8vbmV3cy55YWhvby5jby5qcC9ieWxpbmUvdG9veWFtYXl1c3VrZS8yMDIwMDgwOS0wMDE5MjM4MS_SAQA?oc=5 |

| Watch Alabama principal’s viral ‘Islands in the Stream’ coronavirus video - AL.com Posted: 08 Aug 2020 08:47 PM PDT  "Islands in the Stream" is now "We've been quarantined." A video of an Alabama high school principal singing a spoof of the famous duet by Dolly Parton and Kenny Rogers with her husband has garnered 1.3 million views on Facebook in less than two days as people laugh along at their light-hearted take on the year of coronavirus. Gulf Shores High School Principal Cindy Veazey and her husband Jimmy performed their version of the song (originally written by the Bee Gees, but made famous by Kenny and Dolly), poking fun at the coronavirus, face masks, social distancing, zoom calls and virtual school. The school posted video of the performance on its Facebook page Thursday at 3:32 p.m. and by noon on Saturday, it had surpassed 1 million views. Veazey told AL.com in a phone interview that she did not expect the clip to go viral like it did. She and her husband performed the song for the Gulf Shores High teachers and faculty on their first day back at school because she felt they needed to lighten the mood. "Back-to-school is always stressful for teachers and this year especially," Veazey said. "I said I just need to do something funny and something light because we're all stressed out. "If I'd known this was going to happen, I would have practiced more and gotten a better sound system." The full video is 3:38 long, but the chorus goes as follows: "We've been quarantined, that is where we've been; social distancing, we can't see our friends; stay away from me, if you're not family Or we'll give 'rona each other, uh huh Six feet away from each other, uh huh." Veazey said she wrote the lyrics late at night after seeing other coronavirus parody videos online. Her husband does not work at the school, but she recruited him to perform the song with her for the teacher orientation. "I wanted to get a teacher to do this with me, but I told my husband I couldn't ask anyone on such short notice," Veazey said. "He's a team player." The verses riff on the Walmart toilet paper shortages, Tiger King, teaching from home, and a subtle reminder that "changing out your PJs really wouldn't hurt you." And in perhaps the truest statement of 2020 so far, "and the message is clear, this could be the year we all go insane." *Updated at 5:30 p.m. with comments from Veazey. "viral" - Google News August 08, 2020 at 03:30PM https://ift.tt/3ikxWUD Watch Alabama principal's viral 'Islands in the Stream' coronavirus video - AL.com "viral" - Google News https://ift.tt/2BCxygM Shoes Man Tutorial Pos News Update Meme Update Korean Entertainment News Japan News Update |

| Un dîner-croisière sous la chaleur et sous les masques - Courrier picard Posted: 08 Aug 2020 07:13 PM PDT desimpul.blogspot.com  ANIMATIONS Le onzième dîner-croisière, à Cayeux-sur-Mer, sur le chemin des planches, restera certainement dans les annales. Les conditions ont effet été bien particulières, samedi 8 août. Au coronavirus s'est ajoutée la canicule. August 08, 2020 at 12:38PM https://ift.tt/2PyezuS Un dîner-croisière sous la chaleur et sous les masques - Courrier picard https://ift.tt/2VosBm2 longue robe |

| フリーアナウンサーの塩地美澄「写真集」5位発進 “癒やしボディ”を限界露出 - ORICON NEWS Posted: 08 Aug 2020 07:10 PM PDT フリーアナウンサーの塩地美澄「写真集」5位発進 "癒やしボディ"を限界露出 - ORICON NEWS 元秋田朝日放送の人気アナウンサーで、14年4月からフリーに転身した塩地は現在、バラエティーやグラビアで活躍中。本作では、完全なすっぴんでの一糸まとわぬ大胆な裸身カットにも挑戦するなど、身長165・B 89・W 63・H 88センチの癒やしボディを存分に披露している。 本作発売にあたり、ツイッターで公式アカウント【@2020misumi】を開設。写真集のオフショットや本人からの動画メッセージなどを公開している。 2020-08-08 23:30:12Z https://news.google.com/__i/rss/rd/articles/CBMiK2h0dHBzOi8vd3d3Lm9yaWNvbi5jby5qcC9uZXdzLzIxNjkxMDEvZnVsbC_SASpodHRwczovL3d3dy5vcmljb24uY28uanAvbmV3cy8yMTY5MTAxL2FtcC8?oc=5 |

| Hope in defeating COVID-19: More therapeutic and vaccine advances - Medical News Today Posted: 08 Aug 2020 07:08 PM PDT |

| Posted: 08 Aug 2020 06:48 PM PDT  Saeed Adyani / Netflix; Philippe Antonello/Amazon Studios; Eddy Chen / Netflix; Pop TV; Merie W. Wallace/HBO; ABC Good news, Catherine O'Hara ("Schitt's Creek"): You look to be as close to an Emmy lock as possible. As of this writing, the funny lady has overwhelming 17/5 odds to win Best Comedy Actress, based on the combined predictions of our Experts, Editors, Top 24 Users and All Star Users. The other nominees in this category don't even come close, though there is a two-way tie for second place between Rachel Brosnahan ("The Marvelous Mrs. Maisel") and Issa Rae ("Insecure") at 9/2 odds apiece. Do you agree or disagree with our racetrack odds? Make your Emmy predictions right now. SEE 2020 Emmy nominations complete list: All the nominees for the 72nd Emmy Awards O'Hara plays over-the-top ex-soap star Moira Rose on the Canadian laffer about a rich family that loses everything and has to move to a tiny blue-collar town. This would be O'Hara's first Emmy for acting, though she previously won a trophy for writing "SCTV Network 90" (1982). "Schitt's Creek" was completely skunked for its first four seasons before it broke through last year with four Emmy bids: series, actor, actress and costumes. TV academy voters finally discovered the show thanks to a combination of word-of-mouth and Netflix's acquisition of the old Pop episodes, which they seemingly binge-watched in one fell swoop. Brosnahan won an Emmy in 2018 for her role as a housewife-turned-stand-up-comedian in 1950s New York. She was nominated again last year for "Mrs. Maisel," but lost to Phoebe Waller-Bridge ("Fleabag"). Her first Emmy bid came in 2015 thanks to her guest role on "House of Cards." Rae is looking for her first Emmy after previously being nominated in 2018 for HBO's comedy about the Black female experience in Los Angeles. The multi-hyphenate actress actually has two nominations this year as she's also up for producing "Insecure" in Best Comedy Series. Here are the current Emmy odds for Best Comedy Actress: Catherine O'Hara ("Schitt's Creek") — 17/5 odds Rachel Brosnahan ("The Marvelous Mrs. Maisel") — 9/2 odds Issa Rae ("Insecure") — 9/2 odds Christina Applegate ("Dead to Me") — 11/2 odds Linda Cardellini ("Dead to Me") — 13/2 odds Tracee Ellis Ross ("Black-ish") — 7/1 odds Make your predictions at Gold Derby now. Download our free and easy app for Apple/iPhone devices or Android (Google Play) to compete against legions of other fans plus our experts and editors for best prediction accuracy scores. See our latest prediction champs. Can you top our esteemed leaderboards next? Always remember to keep your predictions updated because they impact our latest racetrack odds, which terrify Hollywood chiefs and stars. Don't miss the fun. Speak up and share your huffy opinions in our famous forums where 5,000 showbiz leaders lurk every day to track latest awards buzz. Everybody wants to know: What do you think? Who do you predict and why? SIGN UP for Gold Derby's free newsletter with latest predictions 2020 Emmy Predictions"Actress" - Google News August 08, 2020 at 04:00PM https://ift.tt/3ioiwi9 Catherine O'Hara ('Schitt's Creek') leads Emmy odds for comedy actress, but who's in 2nd place? - Gold Derby "Actress" - Google News https://ift.tt/31HZgDn Shoes Man Tutorial Pos News Update Meme Update Korean Entertainment News Japan News Update |

| Posted: 08 Aug 2020 06:42 PM PDT

Lionel Messi proved once again what an unstoppable force he is on the pitch with an incredible goal against Napoli on Saturday. With Barcelona already leading 1-0 on the day and 2-1 on aggregate, Messi all but sealed his club's spot in the Champions League quarterfinals with yet another astonishing goal. After receiving a long ball just outside the box, Messi was met by a slew of defenders, and began to deftly weave his way in and out of traffic to continue his advance toward the goal. Messi outfoxed a trio of defenders who attempted to take away his lane, but a tackle brought him to the ground just before he broke free. Undeterred, Messi got up, continued his attack with one final touch to make space as two more defenders closed in, and then sent the ball home to the far corner of the net. For any other player, it'd be a defining goal of their career, but for Messi, it was just another Saturday. —Field Yates (@FieldYates) August 8, 2020 On Twitter, fans were in awe of yet another stunning display of Messi's dominance. —roger bennett (@rogbennett) August 8, 2020 —Arsenal's Bunny. (@Bubble_minakie) August 8, 2020 —Pradeep (@MahakalMessi) August 8, 2020 Messi's stellar day wasn't finished there. Just a few moments later, it looked as though Messi had added to Barca's lead once again, with another impressive light touch to the back of the net. The goal would be disallowed by a somewhat questionable VAR decision, but Messi's skills were still on full display. —Elliot Hackney (@ElliotHackney) August 8, 2020 Just before halftime, Messi would get his revenge on the goal that was taken from him, earning a penalty kick after going down in the box by the foot of a defender. Rather than take the penalty himself and add to his goal total for the night, Messi instead passed the kick off to Suarez, and took time to tie his boot. —Mike Janela (@MikeJanela) August 8, 2020 To be fair, Messi already has plenty of goals on his own. According to ESPN, Messi is responsible for 1.3% of all goals scored in the history of the Champions League. With Barcelona now all but assuredly through to the quarterfinals, there's a good chance he'll further add to that total in the near future.

The 55 athletes who make the most money per minute, ranked "Goal" - Google News August 08, 2020 at 01:59PM https://ift.tt/3gHlnlX Lionel Messi bested 5 defenders and was pushed to the ground before scoring another miraculous goal - Insider - INSIDER "Goal" - Google News https://ift.tt/35TEe8t Shoes Man Tutorial Pos News Update Meme Update Korean Entertainment News Japan News Update |

| How to help Beirut explosion victims - CNN Posted: 08 Aug 2020 06:08 PM PDT  The Lebanese Red Cross is caring for the critically wounded and providing emergency shelter for at least 1,000 residents. You can also help raise funds for supplies and assistance through several US based non-profits by clicking the button below or by clicking here. These charities are on the ground providing medical care, shelter, supplies and other services desperately needed to help the city recover and rebuild. Top stories - Google News August 07, 2020 at 05:16AM https://ift.tt/31mjy7t How to help Beirut explosion victims - CNN Top stories - Google News https://ift.tt/2FLTecc Shoes Man Tutorial Pos News Update Meme Update Korean Entertainment News Japan News Update |

| Jokowi lauds Indonesian innovations in fight against COVID-19 - ANTARA English Posted: 08 Aug 2020 05:08 PM PDT  This fighting spirit is what we must continue to promote in facing this very, very difficult situation Jakarta (ANTARA) - President Joko Widodo (Jokowi) has lauded the innovative products developed by Indonesians in the health sector with the spirit of "gotong royong" (mutual help) to aid the fight against the coronavirus pandemic."We are grateful that there have been various innovations by Indonesians to create various products in the health field that we had previously imported (in) plenty," Jokowi said at the opening of the Extraordinary Congress of Gerindra Party, held online here on Saturday. The conditions under the pandemic have indeed been difficult, however, the difficulty has fostered a spirit of mutual help, cooperation, and sharing of burdens among various elements of the society, he noted. Jokowi said no country was ready to face such a crisis. More than 18 million people have been infected with COVID-19 globally and the death toll has reached 696 thousand so far. Related news: Ranks should not forget big strategic agendas against COVID-19: Jokowi In addition, the economic growth in various countries has also experienced a deep contraction. Some of the figures have been quite grave, including those for France (minus 19 percent), India (minus 18.9 percent), Britain (minus 17.9 percent), and the European Union (minus 14.4 percent), Jokowi said. He also cited IMF's prediction that the global economy is facing its worst financial crisis since the Great Depression of 1930. However, Jokowi urged the Indonesian people to keep their hopes up that the Indonesian nation would be able to deal with the challenges created by COVID-19 by itself. This is because the Indonesian nation is a nation of fighters, he said. "This fighting spirit is what we must continue to promote in facing this very, very difficult situation," he remarked. Gerindra Party was founded by Prabowo Subianto, the current Defense Minister, in February, 2008. Subianto ran against Jokowi during the presidential elections in 2014 and 2019, but lost in both of them. Jokowi belongs to the ruling PDIP. Nearly all political parties, including Gerindra, have currently joined the coalition of the Jokowi administration, except PKS (Justice Prosperous Party) which has remained in the opposition. Related news: Jokowi devises strategy for campaign to propagate COVID-19 protocols Top stories - Google News August 08, 2020 at 04:15AM https://ift.tt/3afLZrJ Jokowi lauds Indonesian innovations in fight against COVID-19 - ANTARA English Top stories - Google News https://ift.tt/2FLTecc Shoes Man Tutorial Pos News Update Meme Update Korean Entertainment News Japan News Update |

| ジャンプ編集部、漫画『アクタージュ』原作者の逮捕報道に謝罪「重く受け止めております」 - ORICON NEWS Posted: 08 Aug 2020 06:08 AM PDT ジャンプ編集部、漫画『アクタージュ』原作者の逮捕報道に謝罪「重く受け止めております」 - ORICON NEWS 『週刊少年ジャンプ』(集英社)は8日、同誌で連載中の役者漫画『アクタージュ act-age』(作画:宇佐崎しろ)の原作者・マツキタツヤ氏が強制わいせつ容疑で逮捕されたことを受け、公式サイトを更新した。 ツイッターでは「この度、週刊少年ジャンプにて連載中の『アクタージュ act-age』原作者のマツキタツヤ先生に関する報道がなされましたが、この件につきまして編集部としましては重く受け止めております」と報告。 続けて「事実関係を確認した上で、適切に対処して参ります」とし、「読者の皆様ならびに関係者の皆様にご迷惑とご心配をおかけいたしますことを、心よりお詫び申し上げます」と伝えた。 2018年1月より同誌で連載がスタートした同作は、大手芸能事務所が主催する俳優オーディションの中で、異彩を放つ少女の主人公・夜凪景と鬼才の映画監督・黒山墨字の出会いから始まり、夜凪が役者として成長する姿を描いた物語。コミックスは300万部を突破しており、ホリプロの公演事業部が制作を手掛ける舞台化も決まっている注目作品。 また、夜凪を実在の女優であるかの様に扱い、企業とのキャンペーンをする「女優化プロジェクト」も実施されており、消防庁の火災予防啓発用ポスターのイメージガール、TSUTAYAの『SHIBUYA TSUTAYA 店長』、『週刊プレイボーイ』で初グラビアを披露していた。 作者は91年生まれの原作・マツキタツヤ氏、97年生まれの作画・宇佐崎しろ氏による若手コンビで、17年に『週刊少年ジャンプ』で掲載された読切り『阿佐ヶ谷芸術高校映像科へようこそ』でデビューした。 2020-08-08 12:04:35Z https://news.google.com/__i/rss/rd/articles/CBMiK2h0dHBzOi8vd3d3Lm9yaWNvbi5jby5qcC9uZXdzLzIxNjkwODEvZnVsbC_SASpodHRwczovL3d3dy5vcmljb24uY28uanAvbmV3cy8yMTY5MDgxL2FtcC8?oc=5 |

| Posted: 08 Aug 2020 05:38 AM PDT 流れ星・ちゅうえい コロナ感染 - auone.jp

サイトでは「弊社所属お笑い芸人流れ星ちゅうえいが新型コロナウイルスに感染していることが、本日8月8日に判明いたしました」と報告。「8月5日の夜に発熱を確認しまして、翌日8月6日に病院の指導のもとPCR検査を受け、本日8月8日感染が判明しました」と説明した。 現状については「自宅待機し、保健所の指示を待っいる状態であり、味覚異常や体調を崩す症状は出ておらず7日以降は平熱の状態です」とし「なお、相方の瀧上伸一郎、マネージャーも本日、8日にクリニックを予約の上、PCR検査を受けており10日に検査結果が出る予定です。現在自宅待機をしており、体調に異常はありません」と記した。 最後は「ファンの皆様、関係各位の皆様へご心配とご迷惑をおかけし、誠に申し訳ございません」と伝え「当社としましては、保健所の判断が示され次第、指導に従って適切に対処し、関係各位の皆様、スタッフへの感染防止、予防、拡大防止の処置を実施してまいります」とした。 2020-08-08 11:02:00Z https://news.google.com/__i/rss/rd/articles/CBMiRmh0dHBzOi8vYXJ0aWNsZS5hdW9uZS5qcC9kZXRhaWwvMS81LzkvMjBfOV9yXzIwMjAwODA4XzE1OTY4ODQ3NjE1NjQ0NjPSAQA?oc=5 |

| 小島瑠璃子『キングダム』原作者・原泰久氏との交際報道に言及「もうその通りです」 - ORICON NEWS Posted: 08 Aug 2020 05:07 AM PDT 小島瑠璃子『キングダム』原作者・原泰久氏との交際報道に言及「もうその通りです」 - ORICON NEWS タレントの小島瑠璃子(26)が8日、自身がパーソナリティーを務めるニッポン放送『さまぁ〜ず 三村マサカズと小島瑠璃子のみむこじラジオ!』(毎週土曜 後5:10)に出演。『NEWSポストセブン』で報じられた、人気漫画『キングダム』原作者で漫画家の原泰久氏との交際報道について「もうその通りです」と明かした。 番組冒頭、三村マサカズ(53)が「きのうの夜ね、玄関先で軽く一服していたら、『こじるりってさ、昔は誰々と付き合っていて、今は誰々と付き合っているんだよ』というのをリアルに聞いた」と明かし「知らない人。俺もしゃがんで一服しているから顔は見えない。ただ2人ぐらいでおじさんだと思うんだけど、俺は今、ものすごいことを聞いているな。結構、身近な人がここにいるんだけどなんて思いながらねぇ」と、うれしそうに説明。 続けて、三村から「どうなんすか? 写真撮られてましたけど」と聞かれると、小島は「はい? なんすか?」ととぼけたものの、三村からデート服にバナナマンのTシャツを着ていたことをツッコまれ、小島は「あれ大好きで。私が一番好きな服をやっぱり持っていったわけですよね」と明かした。 三村が「お付き合いしているってことだもんね」と、さらにツッコむと、小島は「『こんなに感染者数が増えているのに』というご批判が結構あったんです。なんですけどあの頃って一番少なかった時なんですよ。GoToをやっていこうぜ! みたいな時で…」と回顧。 三村から「優しいの? 尊敬からの好きに変わっていったパターン?」などと切り込まれると、小島は「そうですね、あの……人格者ですし。もう尊敬から」と、どぎまぎ。「私、どれぐらいしゃべっていいのか分かんないんですけど、三村さんには言いたいんで言わせてもらうと、もうその通りです」と語った。 小島は「でも、ハッピー!とはやっぱり言っちゃダメみたいなんですよね」と吐露し「(交際は)ボチボチみたいな、ちょっと歯切れ悪い感じになっちゃいますね。申し訳ないですけど。(三村さん)今度お酒を飲みながらゆっくり」と話していた。 『NEWSポストセブン』では「福岡縁結び連泊愛」として小島と原氏の2ショット写真などを交えて伝えていた。 2020-08-08 10:24:44Z https://news.google.com/__i/rss/rd/articles/CBMiK2h0dHBzOi8vd3d3Lm9yaWNvbi5jby5qcC9uZXdzLzIxNjkwODgvZnVsbC_SASpodHRwczovL3d3dy5vcmljb24uY28uanAvbmV3cy8yMTY5MDg4L2FtcC8?oc=5 |

| 小島瑠璃子『キングダム』原作者・原泰久氏との交際報道に言及「もうその通りです」 - auone.jp Posted: 08 Aug 2020 04:07 AM PDT 小島瑠璃子『キングダム』原作者・原泰久氏との交際報道に言及「もうその通りです」 - auone.jp

番組冒頭、三村マサカズ(53)が「きのうの夜ね、玄関先で軽く一服していたら、『こじるりってさ、昔は誰々と付き合っていて、今は誰々と付き合っているんだよ』というのをリアルに聞いた」と明かし「知らない人。俺もしゃがんで一服しているから顔は見えない。ただ2人ぐらいでおじさんだと思うんだけど、俺は今、ものすごいことを聞いているな。結構、身近な人がここにいるんだけどなんて思いながらねぇ」と、うれしそうに説明。 続けて、三村から「どうなんすか? 写真撮られてましたけど」と聞かれると、小島は「はい? なんすか?」ととぼけたものの、三村からデート服にバナナマンのTシャツを着ていたことをツッコまれ、小島は「あれ大好きで。私が一番好きな服をやっぱり持っていったわけですよね」と明かした。 三村が「お付き合いしているってことだもんね」と、さらにツッコむと、小島は「『こんなに感染者数が増えているのに』というご批判が結構あったんです。なんですけどあの頃って一番少なかった時なんですよ。GoToをやっていこうぜ! みたいな時で…」と回顧。 三村から「優しいの? 尊敬からの好きに変わっていったパターン?」などと切り込まれると、小島は「そうですね、あの……人格者ですし。もう尊敬から」と、どぎまぎ。「私、どれぐらいしゃべっていいのか分かんないんですけど、三村さんには言いたいんで言わせてもらうと、もうその通りです」と語った。 小島は「でも、ハッピー!とはやっぱり言っちゃダメみたいなんですよね」と吐露し「(交際は)ボチボチみたいな、ちょっと歯切れ悪い感じになっちゃいますね。申し訳ないですけど。(三村さん)今度お酒を飲みながらゆっくり」と話していた。 『NEWSポストセブン』では「福岡縁結び連泊愛」として小島と原氏の2ショット写真などを交えて伝えていた。 2020-08-08 10:24:00Z https://news.google.com/__i/rss/rd/articles/CBMiRmh0dHBzOi8vYXJ0aWNsZS5hdW9uZS5qcC9kZXRhaWwvMS81LzkvMjBfOV9yXzIwMjAwODA4XzE1OTY4ODIzMzQwODU5OTHSAQA?oc=5 |

| 結婚発表した瀬戸康史&山本美月、祝福の声にそろって喜び 「パワーを貰えました」「嬉しかった」 - ねとらぼ Posted: 08 Aug 2020 04:07 AM PDT 結婚発表した瀬戸康史&山本美月、祝福の声にそろって喜び 「パワーを貰えました」「嬉しかった」 - ねとらぼ 俳優の瀬戸康史さんと山本美月さんが8月8日、SNSを更新。7日の結婚発表後、多くの祝福メッセージを受けたようで、感謝の言葉をつづっています。 ドラマ「パーフェクトワールド」で幼なじみ役として共演した瀬戸さんと山本さんは、連名で結婚を報告。SNSにも書面を掲載し、結婚に至った理由と2人の描く家庭像についてつづると、「新型コロナウイルスの感染拡大の終息、そして私達の故郷でもある、九州地方を含めた『令和2年7月豪雨』による被害の1日も早い復旧を心よりお祈り申し上げます」と締めくくりました。 2人の結婚発表を受け、ファンからはもちろん、瀬戸さんの妹でモデルの瀬戸さおりさんをはじめ、関係者からも祝福の声が続々と寄せられています。「仮面ライダーキバ」で共演した加藤慶祐さんは、2015年に行われた「キバ」の共演者による飲み会で撮影された写真をTwitterに投稿。加藤さん、瀬戸さんと松田賢二さんの3ショットを添えて、瀬戸さんの結婚を祝福しています。 また、『パーフェクトワールド』の原作者である有賀リエさんもTwitterを更新。「おふたりとも本当に優しくて。緊張している私にいろいろ話かけてくれて。とても嬉しかったです」と、瀬戸さん、山本さんと対面した時の思い出をつづり、2人の結婚を祝福した他、滝川英治さん、小池里奈さん、小林豊さん、マルシアさんなどさまざまな人からお祝いの言葉が2人に送られました。 連日、Twitterで「おはようございます!」と朝のあいさつをする瀬戸さんは、多数のお祝いの言葉が送られたことを受け、あいさつに加え「とても嬉しかったですし、皆さんのメッセージからパワーを貰えました」とツイート。山本さんは、愛犬のこつめの写真を添えながら、「あたたかいコメントの一つ一つがとても嬉しかったです! これからも、どうぞよろしくお願いします」と喜びをつづっています。 瀬戸さんのツイートには、「パワーを送れてよかった!!」「幸せオーラを頂けてとても嬉しく思いました」「今日も、『おはようございます』が聞けて嬉しいです」といった反応が寄せられた他、山本さんの投稿には「本当におめでとう!! 幸せになってね」「素敵な家庭築いてね」など温かいメッセージが寄せられています。喜びの連鎖だ。 関連記事Copyright © ITmedia, Inc. All Rights Reserved. 2020-08-08 08:18:00Z https://news.google.com/__i/rss/rd/articles/CBMiO2h0dHBzOi8vbmxhYi5pdG1lZGlhLmNvLmpwL25sL2FydGljbGVzLzIwMDgvMDgvbmV3czA0MC5odG1s0gE2aHR0cHM6Ly9ubGFiLml0bWVkaWEuY28uanAvbmwvYW1wLzIwMDgvMDgvbmV3czA0MC5odG1s?oc=5 |

| Posted: 08 Aug 2020 04:04 AM PDT Edited Transcript of AX_u.TO earnings conference call or presentation 7-Aug-20 5:00pm GMT - Yahoo Finance  Q2 2020 Artis Real Estate Investment Trust Earnings Call WINNIPEG Aug 8, 2020 (Thomson StreetEvents) -- Edited Transcript of Artis Real Estate Investment Trust earnings conference call or presentation Friday, August 7, 2020 at 5:00:00pm GMT TEXT version of Transcript ================================================================================ Corporate Participants ================================================================================ * Armin Martens Artis Real Estate Investment Trust - President, CEO & Trustee * James Green Artis Real Estate Investment Trust - CFO * Kim Riley Artis Real Estate Investment Trust - EVP of Investments & Developments ================================================================================ Conference Call Participants ================================================================================ * Jonathan Kelcher TD Securities Equity Research - Analyst * Matt Logan RBC Capital Markets, Research Division - Analyst ================================================================================ Presentation -------------------------------------------------------------------------------- Operator [1] -------------------------------------------------------------------------------- Good afternoon, ladies and gentlemen. My name is Sylvie, and I will be your conference operator today. At this time, I would like to welcome everyone to Artis REIT's Second Quarter 2020 Conference Call. (Operator Instructions) Today's discussion may include forward-looking statements, which include statements that are not statements of historical facts and statements regarding Artis REIT's future financial performance and its execution or initiatives to deliver unitholder value. Such statements are based on management's assumptions and beliefs. These forward-looking statements are subject to uncertainties and other factors that could cause actual results to differ materially from such statements. Please see Artis REIT's public filings for a discussion of these risk factors, which are included in their annual and quarterly filings, which can be found on Artis REIT's website and on SEDAR. Thank you. And I would like to turn the meeting over to Mr. Armin Martens. Please go ahead, sir. -------------------------------------------------------------------------------- Armin Martens, Artis Real Estate Investment Trust - President, CEO & Trustee [2] -------------------------------------------------------------------------------- Yes. Thank you, moderator. Good day, everyone, and welcome to our Q2 2020 conference call. So again, my name is Armin Martens. I'm the CEO of Artis REIT. And with me on this call is Jim Green, our CFO; Kim Riley, our EVP of Investments; Phil Martens, EVP of U.S. Operations; Jackie Koenig, SVP, Accounting; and Heather Nikkel, VP of Investor Relations is on the call as well. So again, thanks for joining us, folks. I'll begin, as usual, by asking Jim Green to review some of our financial highlights, and then I'll wrap up with some market commentary, and then we'll open the lines for questions. So go ahead please, Jim. -------------------------------------------------------------------------------- James Green, Artis Real Estate Investment Trust - CFO [3] -------------------------------------------------------------------------------- Thanks, Armin, and good afternoon, everyone. So I guess the strange times we talked about last quarter are continuing. However, the economies in both the U.S. and Canada are gradually reopening, and life is getting closer to a new normal despite the ongoing presence of COVID-19 in our economies. For Artis, and I think for most REITs, July and August have seen progressively stronger rent collections than experienced in April, May and June. On the Canadian operations, Artis to date has not participated in the CECRA program as proposed by the federal government. However, in both countries, we have been working with our tenants as needed to provide rent deferrals or in some cases, we've provided rent abatements in exchange for an early renewal or a longer term on the lease. To the end of June, our rents receivable were approximately $12 million with a further $4 million due under deferral agreements that have been executed with our tenants. And while we feel the majority will ultimately be collected, we did book a reserve of approximately $3 million against these balances, which we feel is adequate to cover any potential rent defaults. For July, we've collected 91.8% of our rents due by July 31. And counting amounts collected in July on prior balances, we've collected 93.1% of the rents due in the second quarter. Based on that statistic, it sounds like I'm contradicting myself a little bit about July being stronger. But the way we apply payments is, if a tenant was in arrears at June 30 and they made a payment during July, we treat that as paying off the oldest arrears first before the July rent shows us being paid. You'll recall that our REIT has been working on a planned series of new initiatives, and we're nearing completion of that program, including buying back our units as planned under the NCIB. We've really done that component of the initiatives. However, our ability to sell assets and pay down debt has been impacted by the uncertainty caused by COVID-19. We are, however, starting to see some buyer interest returning, and we expect to see sales activity pick up in Q3 and Q4 this year and into the first half of next year. And as we've stated previously, we plan to use proceeds from further asset sales to pay down debt and further strengthen our balance sheet. Based on our Q2 NOI, the REIT was 47.4% weighted in Canada and 52.6% in the United States. Some of the swing this quarter to be much larger in the U.S. was that all of our retail assets are located in Canada, and this segment has the largest share of the allowance for bad debts. As we move forward, however, we expect the majority of future asset sales will likely be in Canada. And we expect this ratio to continue such that greater than 50% of our income will come from assets in the United States. On an asset class basis, we are presently 47.5% weighted in office, 17.2% in retail and 35.3% in industrial. Artis continues to be active in new developments and redevelopment of our existing properties. We did not start any new this quarter given the COVID lockdowns, but we continue to work on the projects already under development. And to June 30, we have approximately $134 million invested in these projects. During the quarter, there was roughly a further $35 million invested in development projects, and we completed one project and transferred it to regular income-producing properties. As detailed in the MD&A, we have several development projects that remain underway, including the mixed-use residential tower at 300 Main in Winnipeg, new industrial space in Houston and a small retail development already fully leased as additional density on one of our retail sites in Winnipeg. Also as detailed in the MD&A, we have several development projects in the planning stages where we've not actively started. Some of these are virtually ready to go as soon as the COVID situation seems to stabilize. Our balance sheet remains relatively consistent with debt to GBV on a proportionate share basis at 52.5% this quarter versus 52.3% at year-end. Something I don't usually touch on, but I will this quarter, is that Artis has a fairly significant portion of our debt maturing in the next 12 months, with $564 million of mortgage debt in addition to an unsecured debenture for $250 million. Roughly $33 million of the mortgage debt will be repaid just by the regular scheduled principal repayments, and we've already renewed approximately $80 million of the mortgages or roughly 33% of the amount that falls due in 2020. We are not anticipating any difficulty in refinancing the rest. The mortgage debt is spread across approximately 20 properties. Our NOI this quarter was $70.2 million compared to $71.9 million last quarter. It's a drop of $1.7 million, created primarily by almost $3 million as a provision against doubtful accounts and some lower parking revenue as some of our tenants worked from home. They can't necessarily cancel the leases, but they can stop paying for parking if they choose to on a month-by-month basis. And that was partially offset, we were almost $1 million gain on foreign exchange due to higher rates during the quarter. And we also had other than the bad debt allowance, we had same -- positive same-property income that also contributed to the NOI. So despite the drop in NOI, FFO for the quarter was up $49.4 million from $46.4 million last quarter, with the $1.7 million drop in NOI being substantially more than offset by lower interest expenses on our debt as well as reduced corporate expenses. FFO on a per unit basis came in at $0.36 this quarter compared with $0.33 last quarter and was flat unchanged at $0.36 from the same quarter last year. We added a little bit of new disclosure this quarter, breaking out our FFO from each asset class, just using the percentage of NOI as a method of allocation. So on this basis, we earned $0.17 of FFO from our office portfolios, $0.13 from industrial and $0.06 from retail. AFFO for the quarter was $0.27, again, up from Q1 but flat to Q2 of '19. Our payout ratios for the quarter are a very conservative 38.9% of FFO and 51.9% of AFFO. The results from operations on a same-property basis were down to a negative 2% this quarter. You may recall in prior quarters, we had presented a stabilized same-property calculation, which eliminated properties planned for disposition and also backed out the Calgary office portfolio. We were planning on just eliminating the stabilized result this quarter, but as a major factor in the negative same-property result was the allowance booked for doubtful accounts. We did present the number excluding the allowance, and that would have resulted in positive same-property growth of 1.2%. The industrial segment continues to be the strongest performance in both countries, with 6.1% growth in Canada and 3.3% growth in the United States. On the income-producing property portfolio, we are valued on our balance sheet at fair value. And this quarter continued to be a little bit challenging to determine fair value as there has not been a lot of asset sales recently. However, there's no hard evidence that cap rates, discount rates or market rents have moved substantially during the quarter. You may recall that we recorded a fairly substantial reduction in value at the end of Q1, which we felt was adequate coverage. And at the end of Q2, we did not feel any significant further adjustment was warranted. We actually wound up with an increase being booked with the main driver of the increase being the industrial segment, led by the Ontario industrial properties, where the increase in value is largely driven by increasing rental rates. So as we report those investment properties at fair value, we are able to calculate a net asset value per trust unit on an IFRS basis, and our calculation just uses the equity on our balance sheet, less the equity held by the unitholders and then divided by the number of common units outstanding at the end of the quarter. So net asset value per trust unit on that basis was $15.40 this quarter compared to $15.52 last quarter, a net decline of $0.12 due to several factors, the largest of which was foreign exchange, which on a stand-alone basis would have decreased our NAV by $0.42. Other financial instruments, which consist mainly of the debt swaps, contributed a further $0.03 drop in the falling interest rates, and our distributions for the quarter were $0.17. And offsetting those 3 reductions was a gain of $0.34 from our income for the quarter, plus a $0.09 gain from the fair value adjustment and a $0.07 gain due to the purchases under our NCIB. So Artis ended the quarter with $40 million of cash on hand and $172 million undrawn on our line of credit. And based on what we know today, we feel that's more than adequate liquidity to get us through the remainder of the COVID crisis, and we look forward to more normal times. So that completes the financial review for now. I'm happy to answer questions later, but I'll pass it back to Armin for a bit more discussion first. Keep well, everybody. -------------------------------------------------------------------------------- Armin Martens, Artis Real Estate Investment Trust - President, CEO & Trustee [4] -------------------------------------------------------------------------------- Okay. Thanks, Jim. So folks, this has been a volatile and unprecedented year, of course, as you know. But as it applies to Artis, we feel that the worst is already behind us. We really do. Artis is performing very well this year. We continue to make good progress in all key strategic fronts and are delivering strong performance metrics to our unitholders. Our rental increase of same-property NOI or FFO and AFFO per unit are all solid numbers. Our rent collections are good and already improving. Watch for more monthly updates from us in August and September as we move forward that will demonstrate an improving trend. So we're in great shape, and things are looking up. Looking ahead, given our very conservative payout ratio of AFFO for 52% and the progress we've made on the strategic initiatives, debt reduction is and will be a top priority for us. As Jim mentioned, falling floating interest rates are a natural boost to our earnings, which we think is structural and will remain with us long term. So lower for longer or lower for even longer is clearly the new normal for interest rates. It is our view that liquidity and availability of credit will continue to improve as we get to the other side of this shutdown. And all of this, of course, will be good for real estate and REIT valuations. Our property disposition program slowed during Q2, of course. But looking ahead for this year, we anticipate selling at least another $200 million of property by year-end and another $200 million during the first half of next year. So $400 million of property during the next 12 months, all retail and office properties. And again, that price is consistent with our IFRS NAV of $15.40 and again, used for debt reduction. I might add that we already have over $20 million of properties under contract or LOI for sale and another $100 million under discussion with paper being traded. So nobody needs to be concerned about our ability to get this done and pay down our debt. And nobody should even be surprised to see us get all $400 million done by the end of this year. And when I say done by the end of this year, I mean either closed or at least unconditional. But we see good momentum, good traction in our disposition program now coming back to us. It's important to note, of course, that as our financial metrics improve, so do our portfolio of properties. We're continuing to reduce our office and retail weighting and increasing our ownership of industrial properties. We're streamlining and high-grading our portfolio as well as reducing the number of secondary markets we're in. So one could say this is basically a private equity model that we're implementing to maximize unitholder value. It's just that we're also minimizing debt in the process. On balance, our overall portfolio is performing well. Again, we own almost $2 billion of industrial properties, which have a very good track record and continue to deliver solid organic growth on both sides of the border. And our industrial development pipeline is on track to deliver excellent results as well. Stay tuned for more good news on this front as we move to expand our industrial development pipeline with institutional joint venture partners this year and into the very near future. And as a little fun fact, we don't disclose it as well as we could or should, but in the past 5 years, Artis has, in fact, developed over USD 300 million of new generation industrial properties that are generating IRR for us, an average IRR of over 30%. And so we feel good about that asset class. We have a very good track record in developing new generation industrial. We're going to -- we'll continue to grow that. Now in terms of our retail properties, it's important to note that they represent just 17% of our total NOI. And they're all open-air service sector strip malls. And of that retail component, we estimate that approximately 80% of our tenants are selling products and services that are "essential," if you will, essential in the sense that the shopping has to be done primarily in person, not online. So folks, by now, you've noticed that Artis is not your grandmother's diversified REIT anymore. All right? We're not your typical diversified REIT anymore, and we feel we really should not be compared to diversified REITS anymore. And at an 83% weighting, Artis is now an office and industrial REIT with just some retail on the side, which is very resilient retail. And as mentioned, we'll be continuing to shrink both our retail and office weighting whilst growing our industrial. And just to go back a little bit in history, and we've done a lot of heavy lifting in the last 3 years to transform and improve Artis. In the last 3 years alone, we've reduced our Alberta weighting from 36% to 16%, our Calgary office from 15% down to 2%, our retail is down from 26% to 17%. And so in the last 3 years, office is down from 51% to 48%, and industrial is up from 23% to 35% and climbing. So again, a lot of heavy lifting in the past 3 years. If you look at investor presentations, we're targeting by the end of next year to be at 10% retail, to be at 50% industrial, that's 50%, and 40% office, and we'll get there. We'll get there. When we say we're going to sell $400 million of real estate at our NAV and we might get paid on our debt, we will. And when we say we'll hit these targets and asset class allocation, we will. And we'll even do better. That we think -- as I said, a lot of heavy lifting is behind us, and we feel like we're walking -- going down hill now. This pandemic was a serious distraction. But in our case, given the nature of our portfolio, being office and industrial primarily, the worst is behind us. But anyway, that's enough about us. That's our quarter for this, folks. For this quarter, folks, it was a good quarter, for sure. We feel we're going to end the year well. We'll have a very good year this year, and next year will be an even better year. So now I'll turn the floor over to -- mic over to the moderator and open the lines for questions. ================================================================================ Questions and Answers -------------------------------------------------------------------------------- Operator [1] -------------------------------------------------------------------------------- (Operator Instructions) And your first question will be from Jonathan Kelcher at TD Securities. -------------------------------------------------------------------------------- Jonathan Kelcher, TD Securities Equity Research - Analyst [2] -------------------------------------------------------------------------------- Armin, can you maybe, I guess, in your prepared remarks there, you kind of hinted at maybe some sort of JV development fund or something like that. Could you maybe expand on that a little bit? -------------------------------------------------------------------------------- Armin Martens, Artis Real Estate Investment Trust - President, CEO & Trustee [3] -------------------------------------------------------------------------------- Yes. So we're targeting a fund of USD 100 million in equity that in turn could be levered to develop $300 million of new generation industrial. We've got, at the beginning of our pipeline already tied up in terms of properties, a large and new industrial development in Phoenix and another smaller one in Minneapolis to get the ball rolling. And there's 2 ways to skin the cat, Jonathan. One is -- one way or another, we're getting a lot of interest, like a lot of interest from institutional equity partners. An easy way out is for us to just do one joint venture at a time as we move forward with our pipeline. In a perfect world, we'd like to have the fund established in advance and committed. But either way, we'll be moving ahead with a name. You'll recognize the names when we have the deal done for the industrial -- for the joint venture, new generation industrial in Phoenix. And the reason we're doing this, I mean, in a perfect world, we'd like to use our own capital and then own 100%. But with -- right now, all of our positive cash flow is being used to pay down debt as we sell our buildings, to pay down debt, improve the balance sheet, which will give us a better price multiple. And therefore -- but in parallel with that, we don't want to stop doing industrial development deals. So we would be the GP. We'll be a 90-10 deal. 10% equity from Artis, 90% from the JV partner. We'll get an asset management fee. We'll get an override on the leasing, and we're going to promote structure as well, which will -- and that would use up our IRR a lot. Does that help you? -------------------------------------------------------------------------------- Jonathan Kelcher, TD Securities Equity Research - Analyst [4] -------------------------------------------------------------------------------- Yes. That is helpful. And then just switching gears a little bit. Jim, you talked about having a lot of mortgage debt coming due in the next 12 months. What sort of rates are you seeing right now? -------------------------------------------------------------------------------- James Green, Artis Real Estate Investment Trust - CFO [5] -------------------------------------------------------------------------------- So the spreads are -- have definitely gone up in both Canada and the U.S., but the -- with the declines in both BA rates and LIBOR rates, I think the all-in coupon to the borrower, we would be pretty close to our expiring rates. So call it, 5-year debt, still sub-3%, and you get out to 10-year debt, it might be a little over 3%. But... -------------------------------------------------------------------------------- Jonathan Kelcher, TD Securities Equity Research - Analyst [6] -------------------------------------------------------------------------------- And then would you be looking to fix more of that? -------------------------------------------------------------------------------- James Green, Artis Real Estate Investment Trust - CFO [7] -------------------------------------------------------------------------------- On some properties, yes. If it's a property that we plan to hold long term, then we would look to place a longer-term piece of debt on. -------------------------------------------------------------------------------- Jonathan Kelcher, TD Securities Equity Research - Analyst [8] -------------------------------------------------------------------------------- Fixed rates, is that right? -------------------------------------------------------------------------------- James Green, Artis Real Estate Investment Trust - CFO [9] -------------------------------------------------------------------------------- We either fix the rate or protected by a swap, yes. -------------------------------------------------------------------------------- Operator [10] -------------------------------------------------------------------------------- (Operator Instructions) And your next question will be from Matt Logan at RBC. -------------------------------------------------------------------------------- Matt Logan, RBC Capital Markets, Research Division - Analyst [11] -------------------------------------------------------------------------------- Armin, looking through the Q2 bad debts, can you give us a little bit of color on the operating performance of your Canadian office assets? And how those compared to your office properties in the U.S.? -------------------------------------------------------------------------------- Armin Martens, Artis Real Estate Investment Trust - President, CEO & Trustee [12] -------------------------------------------------------------------------------- So I'm going to -- you got the data there, Jim? You have the breakdown? It's -- yes, now -- well, look. We're meddling with mix [for the] -- in there. I think we're a little bit shier on the Canadian side than the U.S. side. What have we got there? -------------------------------------------------------------------------------- James Green, Artis Real Estate Investment Trust - CFO [13] -------------------------------------------------------------------------------- Correct. The allowance for doubtful accounts is larger in the Canadian office than in the U.S. office. The biggest piece, of course, is the retail allowance, but total office allowance is $100 million -- sorry, roughly $850 million out of the 2 point... -------------------------------------------------------------------------------- Armin Martens, Artis Real Estate Investment Trust - President, CEO & Trustee [14] -------------------------------------------------------------------------------- Yes. I -- it's a tough one to call. In the last 90 days, tenants -- it was a little easier to renew a lease, I guess, if a tenant was forced to renew. But to do a new lease was challenging. It was, however, was spotty. I know in Toronto at our Concorde Corporate place there, we've got some good leasing done in the last 90 days actually. We made some good progress. And then other situations, tenants were just not making any decisions. We do the visual -- virtual tours and all that, but that not making decisions. Now specifically, we've got a -- we can't really tell you which tenants, it might be a challenge... -------------------------------------------------------------------------------- James Green, Artis Real Estate Investment Trust - CFO [15] -------------------------------------------------------------------------------- (inaudible) obviously, but the tenants sort of we were having rent collection problems are generally the ones that have some tie-in to retail. So if they were either a head office or servicing the retail sector, then those tenants were struggling a little bit. -------------------------------------------------------------------------------- Armin Martens, Artis Real Estate Investment Trust - President, CEO & Trustee [16] -------------------------------------------------------------------------------- Yes, if you've got a head office of a retail tenant -- or I thought a retail operator, a head office of a restaurant operator, that's --then that's a bit of a challenge. Sometimes, tenants just wanted to push back and say, "During these unprecedented times, let's be partners," and rent reduction's in them. So we'd go back and say, "Nice try." So let's get back to paying rent and as you can demonstrate, I mean for a good reason, we always have a good tenant. But if they don't need help, then we won't get help. But we definitely feel that as we move forward, office market -- I mean industrial market's back to pre-COVID times. Industrial market is strong and robust, really. Office markets, not 100% -- not back to pre-COVID times yet, but improving. And retail is what it is. It does depend what kind of retail you have. We definitely feel and see our retail NOI improving that we think the bomb is behind us with retail. -------------------------------------------------------------------------------- Matt Logan, RBC Capital Markets, Research Division - Analyst [17] -------------------------------------------------------------------------------- Well, would it be fair to say the difference between Canada and the U.S. from an office standpoint might be more tenant specific as opposed to cultural differences or how the tenants are perceiving the value of office space on one side of the border or the other? -------------------------------------------------------------------------------- Armin Martens, Artis Real Estate Investment Trust - President, CEO & Trustee [18] -------------------------------------------------------------------------------- That's -- I would say that. I would say that as well. We're hearing and reading about the trend to more work from home. And larger corporations can afford that, I guess. I think as the dust settles, there won't be as much work from home as we think, but there will be more work at home than there used to be. And then on the other side of that, that measure is that tenants will invariably need more space square feet per employee than they used to need as well. And hopefully, that balances out in favor of the landlord over time. -------------------------------------------------------------------------------- Matt Logan, RBC Capital Markets, Research Division - Analyst [19] -------------------------------------------------------------------------------- And have you done any notable office leasing on either side of the border since the pandemic began? Or have the -- has the leasing mostly been in the industrial portfolio? -------------------------------------------------------------------------------- Armin Martens, Artis Real Estate Investment Trust - President, CEO & Trustee [20] -------------------------------------------------------------------------------- Mostly industrial and a little bit here in Canada as well. And Phil, I don't know if you want to weigh on that at all? And Kim, any new leasing on the office side? And it's -- we'll have our next leasing meetings next week, the next monthly meeting. But it's been neutral. It's been fairly neutral on the office on both sides of the border. But we -- I know our Concorde Corporate plans are there that we saw some good improvements there. And I mean down in Vancouver, the Kincaid office out there, we're getting good momentum there as well. So it's a bit spotty, but these are times when people were just caught like deer in the headlights. They put their pens down, so let's just wait and see. And that's -- but now, people have got the pens in their hand again and they want to do business again. -------------------------------------------------------------------------------- Kim Riley, Artis Real Estate Investment Trust - EVP of Investments & Developments [21] -------------------------------------------------------------------------------- Yes, I could add that we've also ramped up our virtual tour. So we've done, I guess, video of vacant space and then hosts have been able to post that online, which has also helped with leasing activity. So as we were able to ramp that up, we can kind of see the leasing activity pick up as well. -------------------------------------------------------------------------------- Matt Logan, RBC Capital Markets, Research Division - Analyst [22] -------------------------------------------------------------------------------- That's good color. Maybe just changing gears here. The fair value marks during the quarter were about $12 million. Can you tell us what drove those write-ups and tell us if there have been any changes in your valuation inputs from an IFRS standpoint? -------------------------------------------------------------------------------- James Green, Artis Real Estate Investment Trust - CFO [23] -------------------------------------------------------------------------------- No, the valuation approach remains unchanged. We do most of our values on a discounted cash flow basis. And so what was driving the increases in value were generally rent increases. We didn't change discount or terminal cap rates on our original cap rate-type assumptions. That's largely what we receive from the external appraisers, and we get a certain number of external appraisals done each quarter, and then we make sure that our valuation models are mirroring theirs. -------------------------------------------------------------------------------- Matt Logan, RBC Capital Markets, Research Division - Analyst [24] -------------------------------------------------------------------------------- And last question for me, just on your disposition program. Last quarter, you talked about selling about $100 million to $200 million in 2020 and laid out a 2021 target for about $600 million. Are those plans still largely unchanged? And maybe just an update on where those stand? -------------------------------------------------------------------------------- Armin Martens, Artis Real Estate Investment Trust - President, CEO & Trustee [25] -------------------------------------------------------------------------------- So we're definitely confident of our ability to sell $200 million by the end of this year and sell the $200 million by end of first half next year, again, office and retail. We'll see what -- if we continue, we want to get our debt down to closer to 45% of GBV and our debt to EBITDA to 8x. And I don't know -- I don't think $400 million gets us quite there. So in the second half of next year, you should expect us to continue selling down to do that. -------------------------------------------------------------------------------- Operator [26] -------------------------------------------------------------------------------- (Operator Instructions) And at this time Mr. Martens, we have no other questions registered, sir. Please proceed. -------------------------------------------------------------------------------- Armin Martens, Artis Real Estate Investment Trust - President, CEO & Trustee [27] -------------------------------------------------------------------------------- Busy day for all the analysts and a busy week. Anyways, I want to thank you, moderator, and thank you, everyone, who has participated on the call for your interest and looking forward to updated analyst reports next weekend for more dialogue as we move forward. Feel free to reach out to us any time with questions and more information and more dialogue, as we said. Thank you very much. Have a good weekend, everyone. -------------------------------------------------------------------------------- Operator [28] -------------------------------------------------------------------------------- Thank you, sir. Ladies and gentlemen, this does indeed conclude your conference call for today. Once again, thank you for attending. And at this time, we do ask that you please disconnect your lines. 2020-08-08 05:10:08Z https://finance.yahoo.com/news/edited-transcript-ax-u-earnings-031530798.html |

| Posted: 08 Aug 2020 04:04 AM PDT Artis Real Est In Tr (ARESF) CEO Armin Martens on Q2 2020 Results - Earnings Call Transcript - Seeking Alpha [unable to retrieve full-text content]Artis Real Est In Tr (ARESF) CEO Armin Martens on Q2 2020 Results - Earnings Call Transcript Seeking Alpha 2020-08-08 08:01:00Z https://seekingalpha.com/article/4366249-artis-real-est-in-tr-aresf-ceo-armin-martens-on-q2-2020-results-earnings-call-transcript |

| Posted: 08 Aug 2020 02:59 AM PDT Princess Diana's Bridesmaid Opens Up About Her Visit to Jeffrey Epstein's Island - Yahoo Singapore News  View photos Photo credit: David M. Benett - Getty Images Jeffrey Epstein was known for his high profile social network, a circle that keeps widening as previously sealed documents are made public in his associate Ghislaine Maxwell's ongoing court proceedings. This week, after two travel logs from Epstein's private jet with her name on them were released by the court, British writer Clementine "Clemmie" Hambro, a great-granddaughter of Sir Winston Churchill, who was a young bridesmaid at the 1981 royal wedding of Prince Charles and the late Princess Diana, issued a statement clarifying her connection to Epstein, and the purpose of those trips, one of which was to his private island.  View photos Photo credit: PA Images - Getty Images "The first flight was a work trip with female colleagues to look at Epstein's new home in Santa Fe to discuss what art he was going to buy," she said, per the Daily Mail. Hambro was an employee of Christie's auction house in New York at the time. "The second trip, to Little St James, was a personal invitation, which I thought would be fun to accept, but I didn't know anyone there, didn't really enjoy myself, and never went back," she said. "My heart breaks for all the survivors, now I know what happened on that island." In the statement, Hambro confirmed that she was not abused, and she did not witness anyone being abused while on either of the two trips. "I have been completely horrified about the revelations of his conduct since then. I was clearly very lucky, my heart goes out to those who were abused by him, and I trust they get the justice they so deserve," she said. Epstein was arrested last summer on multiple counts related to sex trafficking. He died by suicide in jail. Maxwell was arrested earlier this year on charges related to the sexual abuse of young women and girls, and is currently behind bars, awaiting trial. She has denied the accusations against her and pleaded not guilty. You Might Also Like 2020-08-07 21:38:00Z https://news.google.com/__i/rss/rd/articles/CBMiTWh0dHBzOi8vc2cubmV3cy55YWhvby5jb20vcHJpbmNlc3MtZGlhbmFzLWJyaWRlc21haWQtb3BlbnMtaGVyLTIxMzgwMDAxNi5odG1s0gFVaHR0cHM6Ly9zZy5uZXdzLnlhaG9vLmNvbS9hbXBodG1sL3ByaW5jZXNzLWRpYW5hcy1icmlkZXNtYWlkLW9wZW5zLWhlci0yMTM4MDAwMTYuaHRtbA?oc=5 |

| Posted: 08 Aug 2020 02:59 AM PDT Starlights disappointed after seeing Hongbin returning to his Twitch activities an hour after official Jellyfish announcement - allkpop  Fans of VIXX, also known as Starlights, are overcome with disappointment after Jellyfish Entertainment officially announced member Hongbin's departure from the group. Earlier this week, former VIXX member and online game streamer Hongbin indicated his intentions to return to his Twitch activities, approximately 5 months after coming under fire for his derogatory remarks about other idol groups like INFINITE, SHINee, etc. Less than a day afterward, VIXX's label Jellyfish Entertainment confirmed Hongbin's departure from the group as well as from the agency. Fans then quickly noticed Hongbin erasing his account from VIXX's fan cafe without a word. An hour after Jellyfish Entertainment's official announcement, Hongbin was seen returning to his Twitch channel. The streamer carried out a short, live chat session with his followers, confirming his intentions to continue his streamer activities. Allegedly, Hongbin was seen referring to Starlights as "former fans from my days in VIXX", "fans of the idol group VIXX", "Fans from that side", etc.  Disappointed fans left comments such as, "Even though I stopped liking him after that drunk broadcast, I didn't leave bad comments or anything because I spent a long time liking him... but seeing his behavior from today, I feel like crying and like I wasted my time liking this person", "Would it have been so hard to leave a personal message to the fans before leaving like that", "What happened to the Hongbin who was shaking from being nervous while he gave me an autograph at the fansign... I didn't know a person could change this much. If I'm this shocked, the VIXX members must be going through so much", "Did the team VIXX mean so little to him... He just cut off all ties without an ounce of manners", "He did all that damage to the team's image and then just up and left without looking back once. I'm embarrassed out of my mind for liking someone like him", "You know I was worried about you after that drunk broadcast because of all the backlash, but then you go and refer to me as 'The fans of that idol group VIXX'? That's just not it", etc. Meanwhile, VIXX members including N, Leo, and Ken are currently carrying out their mandatory military service duties. Member Ravi is promoting as a solo artist and through variety program appearances, while maknae Hyuk is promoting as a solo artist and actor. 2020-08-08 06:45:00Z https://news.google.com/__i/rss/rd/articles/CBMipQFodHRwczovL3d3dy5hbGxrcG9wLmNvbS9hcnRpY2xlLzIwMjAvMDgvc3RhcmxpZ2h0cy1kaXNhcHBvaW50ZWQtYWZ0ZXItc2VlaW5nLWhvbmdiaW4tcmV0dXJuaW5nLXRvLWhpcy10d2l0Y2gtYWN0aXZpdGllcy1hbi1ob3VyLWFmdGVyLW9mZmljaWFsLWplbGx5ZmlzaC1hbm5vdW5jZW1lbnTSAQA?oc=5 |

| 柳楽優弥、三浦春馬さんに「ごめんね」 撮影で優しさがにじみ出て… - goo.ne.jp Posted: 08 Aug 2020 01:37 AM PDT 柳楽優弥、三浦春馬さんに「ごめんね」 撮影で優しさがにじみ出て… - goo.ne.jp  劇中で柳楽は核エネルギーの研究者・石村修、三浦さんはその弟・裕之を、有村は兄弟が思いを寄せる女性・朝倉世津をそれぞれ演じている。番組では、事前に収録した三浦さんのインタビュー映像も流された。 インタビューで三浦さんは、柳楽との思い出として、自暴自棄になった裕之を修が海から引き戻して、ビンタをするという場面を挙げた。「どうしても柳楽くんの優しさが出てしまって、子犬をなでるような芝居になってしまったのは印象的でした」などと笑顔で語っていた。 司会のハリセンボン・近藤春菜はVTR明けから涙声。「海でのシーンが印象的とおっしゃってましたが」と何とか言葉を絞り出した。 目を潤ませていた柳楽も「そうですね…」と何とか泣くのをこらえ、「そうですね、いま、春馬くんがおっしゃっていたビンタをする。前日すごい長い間リハーサルをして、一発しかできない撮影だったので、朝日を狙って。修はビンタをするキャラクターではないと監督と話していて…。春馬くんが思ってたのは知らなくて、ごめんね。犬をなでるように…やさしくなっちゃったかな」と謝罪した。ただ、手応えは十分で、「条件のある撮影の中で確実にいいシーンが撮れたという達成感はありました」と胸を張った。 撮影中は、周囲を引っ張るタイプではない柳楽は「春馬くんがいるだけでみんなを笑顔にできるし、常にみんなが求めてたり、気になってる部分を感じ取ってしっかり解消していく。人として素晴らしい方だなと思ってます」と、三浦さんの愛された人柄を振り返った。 2020-08-08 06:38:00Z https://news.google.com/__i/rss/rd/articles/CBMiSWh0dHBzOi8vbmV3cy5nb28ubmUuanAvYXJ0aWNsZS9kYWlseXNwb3J0cy9lbnRlcnRhaW5tZW50LzIwMjAwODA4MDc4Lmh0bWzSAU1odHRwczovL25ld3MuZ29vLm5lLmpwL2FtcC9hcnRpY2xlL2RhaWx5c3BvcnRzL2VudGVydGFpbm1lbnQvMjAyMDA4MDgwNzguaHRtbA?oc=5 |

| 14 of the most outrageous things Trump said in his latest speech - indy100 Posted: 08 Aug 2020 12:08 AM PDT  Donald Trump and public speaking is the gift that keeps on giving and we are pleased to say that he has delivered the goods again. During a trip to Ohio, the president gave not one but two public speeches. The first wasn't so eventful but did see him tell a small crowd on a runway in Cleveland that Joe Biden is "against God." The president then moved on to Clyde, where he was speaking at a Whirlpool washing machine manufacturing plant as part of an official White House event. As always with Trump, you can't bank on him remaining impartial and he turned something that shouldn't have been political into an unofficial campaign rally. Trump kicked things off by praising Whirlpool but it didn't take long for him to launch into an attack on the Obama administration, which he claimed did nothing to protect American workers and allowed foreign appliances into the United States, costing people their jobs.

He then called Obama and Biden a 'joke' and said that they were happy to let China win. Then came probably the moment that this speech will be most remembered for when the POTUS managed to mispronounced the relatively easy to say 'Thailand' as 'Thighland.' We shudder to think about what was going through the president's head at this moment. Trump praised Whirlpool for a little bit longer before he began ranting about 'globalisation' and 'globalists' which he doesn't seem to be a big fan of. Trump then began talking about the US Embassy in Jerusalem, which he did move from Tel Aviv in 2018, but that didn't make Jerusalem the capital of Israel, like he said, as it already had been for thousands of years.

He then made some more campaign pledges to keep jobs in America before again targetting China for the coronavirus outbreak, which he still continues to give a variety of names.

Continuing to talk about coronavirus, Trump praised the number of ventilators that are now being built in the United States before confusingly saying "everybody in our country has it." Trump then moved on to talk about pharmaceuticals and drug prices, which he used as another chance to mock Biden, which seemed to get a big reaction from the audience. Trump seemed to be wrapping up before he appeared to get a second wind and began rambling about water and washing his hair. Trump also complained about eco-friendly lightbulbs which he called 'hazardous waste' and also complained about the way that they made him look.

The president moved back to mocking Joe Biden but his attempt to mock his opponent backfired after completely fluffed his joke which was preceeded by a jumble of words which made no sense at all.

He then lamented deals that the US has with Germany, South Korea and China before attempting to criticise the Democrats for implementing policies that will tackle the climate crisis and claimed that congresswoman Alexandria Ocasio-Cortez knows as much about the environment as a small child. Before wrapping up, Trump moaned about not being able to use stronger force on the Black Lives Matter protesters in Minneapolis before claiming that the Democrats are going to end the second amendment.

Trump ended things by finally allowing some representatives of Whirlpool to speak but to be honest, everybody had probably checked out by that point anyway. Top stories - Google News August 07, 2020 at 12:45AM https://ift.tt/2DI6YHu 14 of the most outrageous things Trump said in his latest speech - indy100 Top stories - Google News https://ift.tt/2FLTecc Shoes Man Tutorial Pos News Update Meme Update Korean Entertainment News Japan News Update |

| Volunteers release thousands of baby sea turtles into the ocean | ABC News - ABC News Posted: 08 Aug 2020 12:08 AM PDT [unable to retrieve full-text content] Volunteers release thousands of baby sea turtles into the ocean | ABC News ABC NewsView Full coverage on Google NewsTop stories - Google News August 07, 2020 at 02:01PM https://ift.tt/33ESAdS Volunteers release thousands of baby sea turtles into the ocean | ABC News - ABC News Top stories - Google News https://ift.tt/2FLTecc Shoes Man Tutorial Pos News Update Meme Update Korean Entertainment News Japan News Update |

| 渡辺二冠がすごい手 名人の長考「間違いない」~飯島七段の解説【第78期将棋名人戦第5局】 - 朝日新聞社 Posted: 08 Aug 2020 12:07 AM PDT 渡辺二冠がすごい手 名人の長考「間違いない」~飯島七段の解説【第78期将棋名人戦第5局】 - 朝日新聞社 [unable to retrieve full-text content]

2020-08-08 06:30:22Z https://news.google.com/__i/rss/rd/articles/CBMiK2h0dHBzOi8vd3d3LnlvdXR1YmUuY29tL3dhdGNoP3Y9WjNpeHZhb2ZBR3fSAQA?oc=5 |

| You are subscribed to email updates from De Blog Have Fun. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Bagikan Berita Ini

0 Response to "De Blog Have Fun"

Post a Comment