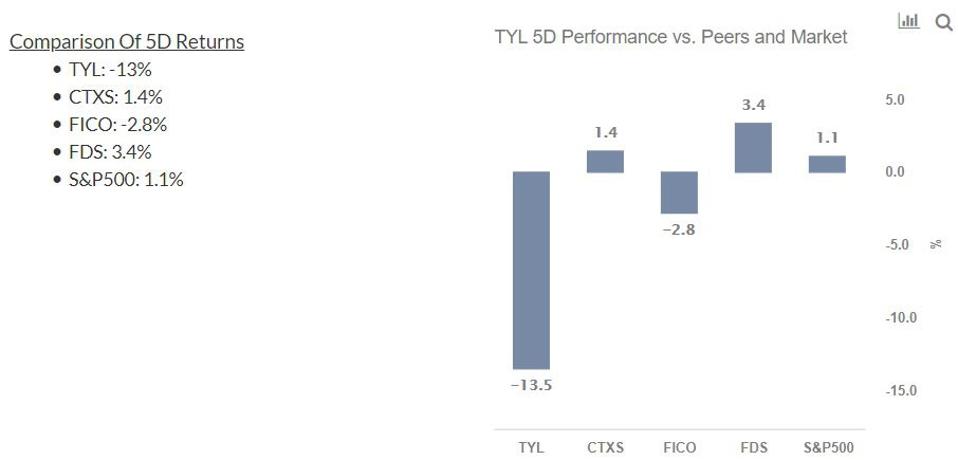

Tyler Technologies’ stock (NYSE: TYL) has fallen by 13% over the last five trading days. In comparison, the broader S&P500 rose by 1.1% over the last five trading days. On 3rd March, 2021 the company announced proposed offerings of Convertible Senior Notes with aggregate principal amount of $1 billion due 2026 and Convertible Senior Notes with aggregate principal amount of $0.6 billion due 2028. This expected rise in debt led to the fall in the stock over the last week. Now, is TYL’s stock poised to grow? As a similar change has occurred very few times historically, we can’t directly use historical trends to draw a conclusion based on our machine learning analysis of trends in the stock price over the last five years. However, keeping in mind the fact that the stock has seen an unusually sharp drop in price over the last five days, we believe that the trend will likely reverse over the coming month. See our analysis on Tyler Technologies Stock Chances Of Rise for more details.

Five Days: TYL -13%, vs. S&P500 1.1%; Underperformed market

(Extremely rare event)

- TYL stock declined 13% over a five day trading period ending 3/05/2021, compared to the broader market (S&P500) rise of 1.1%

- A change of -13% or more over five trading days is an extremely rare event, which has occurred 3 times out of 1256 in the last five years

Ten Days: TYL -15%, vs. S&P500 -1.4%; Underperformed market

(9% likelihood event)

- TYL stock declined 15% over the last ten trading days (two weeks), compared to the broader market (S&P500) decline of 1.4%

- A change of -15% or more over ten trading days is a 9% likelihood event, which has occurred 113 times out of 1240 in the last five years

Twenty One Days: TYL -6.2%, vs. S&P500 0.6%; Underperformed market

(14% likelihood event)

- TYL stock declined 6.2% over the last twenty-one trading days (one month), compared to the broader market (S&P500) rise of 0.6%

- A change of -6.2% or more over twenty-one trading days is a 14% likelihood event, which has occurred 176 times out of 1198 in the last five years

While Tyler Technologies stock may have moved, 2020 has created many pricing discontinuities which can offer attractive trading opportunities. For example, you’ll be surprised how the stock valuation for Tyler Technologies vs. Installed Building Products shows a disconnect with their relative operational growth. You can find many such discontinuous pairs here.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams

"enter" - Google News

March 11, 2021 at 05:30PM

https://ift.tt/2PTrknj

Tyler Technologies Stock Dropped Last Week, Time To Enter? - Forbes

"enter" - Google News

https://ift.tt/2TwxTMf

https://ift.tt/3d6LMHD

Bagikan Berita Ini

0 Response to "Tyler Technologies Stock Dropped Last Week, Time To Enter? - Forbes"

Post a Comment